Explore our in-depth HYCM review for insights on their platforms, account options, and competitive fees. Discover how HYCM ranks in the Forex industry to make an informed trading decision.

Quick Overview:

| Website: | hycm.com | |

| License: | 🇬🇧 🇰🇾 🇦🇪 🇻🇨 | |

| Established: | 1977 | |

| Broker Type: | ECN, MM | |

| Instruments: | 300+ | |

| Max Leverage: | 1:500 | |

| Min Deposit: | 20$ | |

| Fees: | Low-Medium | |

| Support: | 24/5 |

| Segregated accounts | ||

| Compensation Fund | ||

| Algo Trading | ||

| Copy Trading | ||

| PAMM Accounts | ||

| Signals | ||

| Demo Account | ||

| Cent Account | ||

| Bonuses & Contests |

- Over 300 trading instruments

- Leverage up to 1:5000

- Comprehensive platform selection, including MT4, MT5, and mobile trading

- Competitive spreads with no hidden fees

- Negative balance protection

- Islamic (swap-free) account options

- No support for cryptocurrencies on some account types

- Higher minimum deposit requirements for some accounts

- Limited 24/5 customer support

HYCM Review 2024: Is It the Best Forex Broker for You?

Introduction

HYCM (Henyep Capital Markets) is one of the most established brokers in the forex and CFD industry, with over 40 years of experience since its founding in 1977. Headquartered in London, HYCM has earned a reputation for providing reliable and regulated trading services across multiple asset classes. It offers traders access to the global financial markets with a comprehensive range of instruments, flexible account types, and cutting-edge trading platforms.

With a global presence in several major financial centers, including the UK, Cyprus, and Hong Kong, HYCM has positioned itself as a trusted and secure broker for both novice and seasoned traders. Whether you are looking for a low-cost trading environment or advanced trading tools, this in-depth review of HYCM will cover everything from its regulatory framework and trading platforms to fees and customer support.

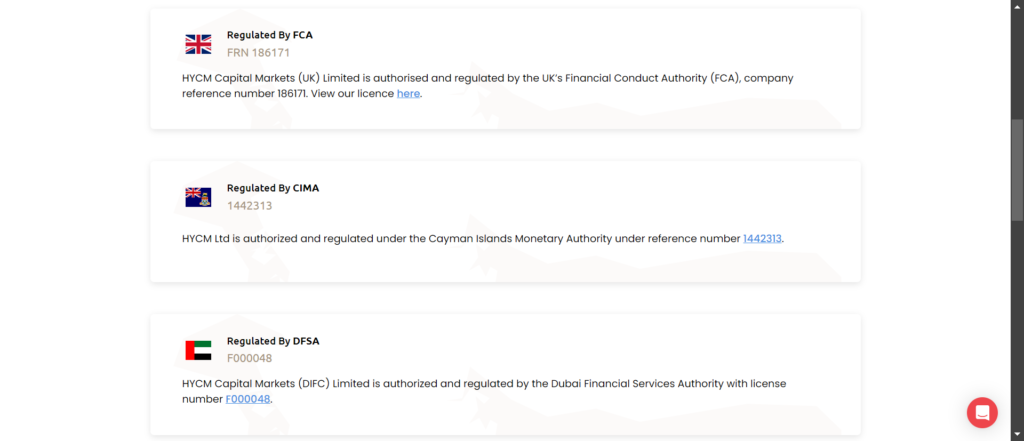

Regulation and Safety: Is HYCM a Safe Broker?

One of the most critical factors in choosing a forex broker is its regulatory status, and HYCM excels in this area. The broker is regulated by several top-tier financial authorities, ensuring that it adheres to stringent standards for security, transparency, and client fund protection.

HYCM is regulated by the following entities:

- FCA (Financial Conduct Authority) – UK: The FCA is one of the most respected regulators in the financial industry, known for its strict oversight and enforcement of best practices. HYCM’s FCA regulation means it complies with high standards for capital adequacy, client fund segregation, and financial reporting.

- CySEC (Cyprus Securities and Exchange Commission): As part of the European regulatory framework, CySEC ensures that HYCM complies with the EU’s MiFID II (Markets in Financial Instruments Directive), which requires brokers to provide transparent trading conditions, secure client funds, and adhere to best execution practices.

- CIMA (Cayman Islands Monetary Authority): The CIMA is another reputable regulatory body that oversees financial services in the Cayman Islands, ensuring that HYCM’s global operations are well-monitored and compliant.

- DFSA (Dubai Financial Services Authority): HYCM is also regulated by the Dubai Financial Services Authority (DFSA), which oversees financial services activities within the Dubai International Financial Centre (DIFC). The DFSA is a respected regulatory body in the Middle East and holds brokers to high standards of transparency and financial stability. The inclusion of DFSA regulation allows HYCM to serve clients in the Middle Eastern markets with the assurance of local regulatory oversight.

Client Fund Security:

HHYCM takes client fund safety seriously, following the strict protocols laid out by its multiple regulators. Client funds are held in segregated accounts with trusted banks, ensuring that they are kept separate from the broker’s operational funds. This segregation provides protection in the event of financial difficulties, as client funds remain accessible for withdrawal.

Furthermore, HYCM offers negative balance protection for retail clients. This crucial feature ensures that traders cannot lose more than their deposited amount, even in cases of extreme market volatility. Negative balance protection is an important safeguard, especially during events like flash crashes or highly volatile market conditions.

See more HYCM’s Regulatory Compliance

Compensation Fund:

HYCM clients are also covered by compensation schemes depending on their regulatory jurisdiction:

- FSCS (Financial Services Compensation Scheme): Clients under FCA regulation in the UK are protected up to £85,000 per client by the FSCS. This scheme compensates clients if the broker is unable to meet its financial obligations.

- ICF (Investor Compensation Fund): Under CySEC regulation, clients are covered up to €20,000 by the Investor Compensation Fund, which provides additional security if HYCM becomes insolvent.

- Additional Compensation under DFSA Regulation: Clients trading under the DFSA regulation benefit from local compensation schemes in the UAE, adding another layer of protection.

HYCM Account Types: Which is Right for You?

HYCM caters to a wide range of traders by offering multiple account types designed to meet various trading strategies, risk appetites, and experience levels. The broker offers three primary account types, along with options for Islamic (swap-free) accounts for traders who adhere to Sharia law.

1. Fixed Spread Account

The Fixed Spread Account is ideal for beginners or traders who prefer cost transparency. As the name suggests, spreads are fixed, meaning they do not fluctuate even during times of high volatility. This allows traders to know their trading costs upfront, which is beneficial for those who are just starting and may be unfamiliar with how variable spreads work.

- Key Features:

- Spreads fixed at 1.8 pips for major forex pairs.

- No commission on trades.

- Minimum deposit: $100.

- Leverage: Up to 1:500 for non-EU clients and 1:30 for EU clients under FCA and CySEC regulation.

2. Classic Account

The Classic Account is tailored for intermediate traders who prefer tighter, variable spreads and more flexibility in their trading. While spreads are not fixed, they are still competitive, starting from 1.2 pips. This account is commission-free, making it suitable for those who want to avoid paying additional fees beyond the spread.

- Key Features:

- Spreads starting from 1.2 pips.

- No commission on trades.

- Minimum deposit: $100.

- Leverage: Up to 1:500 for non-EU clients and 1:30 for EU clients.

3. Raw Account

The Raw Account is designed for professional traders who require the tightest spreads and are willing to pay a small commission per trade. With spreads starting from as low as 0.2 pips, this account is perfect for scalpers and high-frequency traders who need precision and the lowest possible costs.

- Key Features:

- Spreads from 0.2 pips.

- Commission: $4 per round trip.

- Minimum deposit: $200.

- Leverage: Up to 1:500 for non-EU clients.

Islamic Accounts

HYCM also offers Islamic (swap-free) accounts for traders who need to comply with Sharia law. These accounts do not incur interest on overnight positions, allowing traders to participate in the markets without violating Islamic principles.

See more HYCM’s Account Type details

FIXED

Classic

Raw

Trading account type with the best conditions available at the company. It is suitable for both currency and other types of markets.

| Account currency | USD |

| Minimum desposit | 20 USD |

| Expert advisor | No |

| Minimum volume per trade | 0.01 |

| Maximum leverage | 1:500 |

| Spread | Fixed from 1.5 |

| Swap free ** (Islamic) | Yes |

| Maximum number of orders | Unlimited |

| Cryptocurrencies | 19 |

| FX | 67 |

| Metals | 8 |

| Energy | 3 |

| Commodities | 4 |

| Indices | 28 |

| Stocks | 212 |

| Commission | No |

The choice of experienced traders, which combines the highest order execution speed and competitive trading conditions.

| Account currency | USD, EUR, GBP, AED, JPY |

| Minimum deposit | 20 USD |

| Expert advisor | Yes |

| Minimum volume per trade | 0.01 |

| Maximum leverage | 1:500 |

| Spread | Variable from 1.2 |

| Swap free** (Islamic) | Yes |

| Maximum number of orders | Unlimited |

| FX | 66 |

| Metals | 8 |

| Energy | 3 |

| Commodities | 4 |

| Indices | 25 |

| Stocks | 212 |

| Cryptocurrencies | 19 |

| Commission | No |

A specific account type for trading through the R StocksTrader web platform and mobile app of the same name.

| Account currency | USD, EUR, GBP, AED, JPY |

| Minimum deposit | 20 USD |

| Expert advisor | Yes |

| Minimum volume per trade | 0.01 |

| Maximum leverage | 1:500 |

| Spread | Variable from 0.1 |

| Spread** (Islamic) | Yes |

| Maximum number of order | Unlimited |

| FX | 66 |

| Metals | 8 |

| Energy | 3 |

| Commodities | 4 |

| Indices | 25 |

| Stocks | 212 |

| Cryptocurrencies | 19 |

| Commission | |

| FX | 4 USD per round |

| Metals | 5 USD per round |

| Others | 0 USD per round |

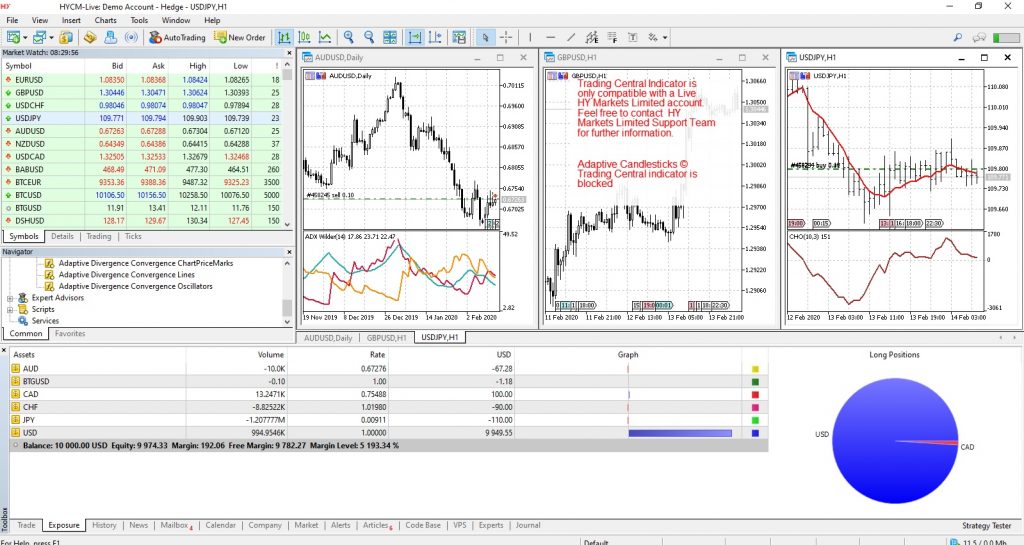

Explore HYCM Trading Platforms: MT4, MT5, and HYCM Mobile App

HYCM provides access to two of the most widely used trading platforms globally: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are known for their user-friendly interfaces, advanced charting tools, and robust capabilities for technical analysis and automated trading.

MetaTrader 4 (MT4)

MT4 is one of the most popular platforms in the world, offering an intuitive interface, customizable charts, and access to a wide range of trading instruments. It is particularly favored for its support of Expert Advisors (EAs), which allow traders to automate their strategies.

- Key Features:

- Advanced charting tools with multiple timeframes.

- Over 50 built-in technical indicators.

- Support for Expert Advisors (automated trading).

- Available on desktop, web, and mobile.

MetaTrader 5 (MT5)

MT5 is the next generation of the MetaTrader platform, offering all the features of MT4, but with additional tools for traders who require more advanced functionalities. MT5 supports more order types, more timeframes, and a wider range of asset classes, making it ideal for traders who want to diversify their portfolios.

- Key Features:

- Support for more asset classes, including stocks and ETFs.

- Additional order types (pending orders).

- Enhanced charting tools and economic calendar.

- Available on desktop, web, and mobile.

HYCM Mobile App

For traders who are always on the go, HYCM offers a proprietary mobile trading app. The app provides full functionality, including real-time market data, one-click trading, and account management features. Traders can monitor their positions and execute trades with ease, ensuring they never miss an opportunity.

HYCM Trading Instruments: A Broad Range of Markets

HYCM offers an impressive selection of over 300 trading instruments, including:

1. Forex:

- More than 69 currency pairs, including major, minor, and exotic pairs.

- High liquidity and 24/5 market access.

2. Stocks:

- Trade CFDs on major global stocks from the NYSE, NASDAQ, London Stock Exchange, and more.

- Companies include household names like Apple, Tesla, and Amazon.

3. Commodities:

- Precious metals such as gold, silver, and platinum.

- Energy commodities, including oil and natural gas.

4. Indices:

- Global indices such as the S&P 500, NASDAQ, FTSE 100, DAX, and more.

- Trade CFDs on both rising and falling markets.

5. Cryptocurrencies:

- Trade cryptocurrency CFDs on popular assets like Bitcoin, Ethereum, Ripple, and Litecoin.

- Benefit from leverage and the ability to trade in both directions.

HYCM Spreads, Fees, and Commissions: Transparent and Competitive

HYCM maintains a competitive fee structure, though it varies based on the account type and asset class being traded:

- Fixed Account: Offers fixed spreads starting from 1.8 pips with no commissions.

- Classic Account: Features variable spreads starting from 1.2 pips, with no commission.

- Raw Account: Provides the tightest spreads, starting from 0 pips, but includes a commission of $4 per round lot.

HYCM also provides swap-free accounts for Islamic traders and runs promotions and rebates from time to time, further enhancing trading conditions for active traders.

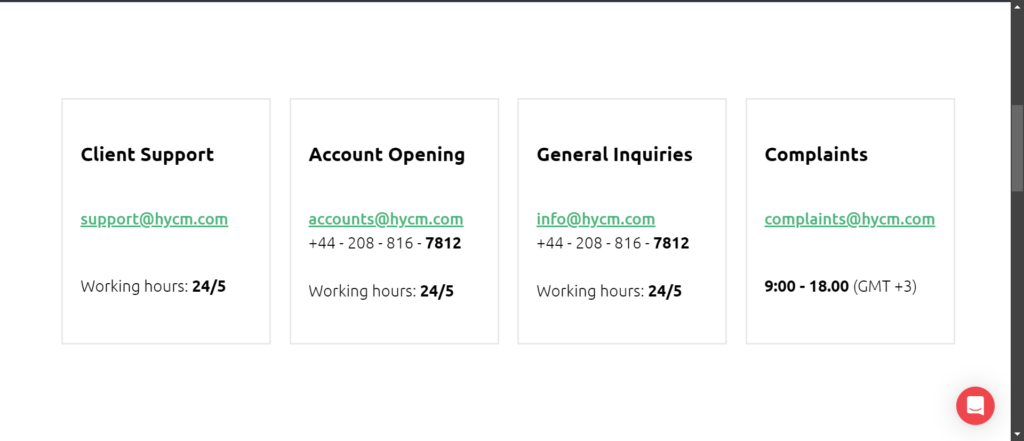

HYCM Customer Service and Support: 24/5 Multilingual Assistance

HYCM’s customer service is available 24/5 and can be accessed via live chat, phone, and email. The broker’s support team is multilingual, ensuring that clients from various parts of the world can communicate effectively. HYCM also offers a comprehensive FAQ section on its website, which covers a wide range of topics, from account opening to trading platform usage.

Support Channels:

Email: Ideal for detailed inquiries that require more thorough answers.

Live Chat: Fastest response time and available during trading hours.

Phone: Direct contact with a support representative.

Educational Resources and Tools: Supporting Traders’ Development

HYCM places significant emphasis on trader education, offering a range of materials suitable for both beginners and advanced traders:

Market News and Analysis: Regular updates keep traders informed about key events and trends impacting the markets.

Webinars and Seminars: Live sessions cover everything from basic trading strategies to more advanced topics like risk management and market analysis.

Articles and E-books: HYCM offers a library of educational content to help traders build their knowledge.

Demo Accounts: Traders can practice in a risk-free environment, testing strategies and getting familiar with the platform before committing real funds.

Our Conclusion: How Does HYCM Compare as a Forex Broker?

"HYCM has earned a reputation for reliability and professionalism, supported by a strong regulatory framework and decades of experience. Its broad range of account types, extensive educational resources, and access to leading trading platforms make it a suitable choice for traders of all levels. With a transparent fee structure and exceptional customer support, HYCM is a well-rounded broker that can meet the needs of both novice and experienced traders alike."

whatsthebestbroker.com