Go Markets offers regulated Forex trading on MT4/MT5, competitive pricing, multiple account types, 24/7 support, and educational tools for traders of all levels.

Quick Overview:

| Website: | gomarkets.com | |

| License: | 🇨🇾 CySec 🇦🇺 ASIC 🇬🇧 FCA | |

| Established: | 2006 | |

| Broker Type: | ECN, STP | |

| Instruments: | 1000+ | |

| Max Leverage: | 1:500 | |

| Min Deposit: | 200$ | |

| Fees: | Low | |

| Support: | 24/7 |

| Segregated accounts | ||

| Compensation Fund | ||

| Algo Trading | ||

| Copy Trading | ||

| PAMM Accounts | ||

| Signals | ||

| Demo Account | ||

| Cent Account | ||

| Bonuses & Contests |

- More then 1000+ Instruments

- Leverage up to 1:500

- Comprehensive platform selection, including MT4, MT5, web trader, PAMM and cTrader

- Competitive pricing with transparent fee structures

- 24/7 multilingual customer support

- Cryptocurrency availability may be limited, depending on region or account type

- Limited leverage in some regions

- Minimum deposit of $200

Go Markets Review 2024: Is It the Best Forex Broker for You?

Introduction

As a trusted broker in the Forex industry since 2006, Go Markets has built a solid reputation for providing traders with competitive pricing, reliable trading platforms, and exceptional customer support. With its global presence and regulation by top-tier financial authorities, Go Markets aims to offer a secure and efficient trading environment for both beginner and advanced traders. In this in-depth review, we will dive into everything you need to know about Go Markets, including its regulation, account types, trading platforms, fees, and customer service. By the end, you’ll have a clear understanding of whether Go Markets is the right broker for your trading journey.

Regulation and Safety: Is Go Markets a Safe Broker?

Go Markets takes security seriously, operating under the regulation of multiple financial authorities to ensure traders’ safety and transparency. These include:

Australian Securities and Investments Commission (ASIC): Go Markets is regulated by ASIC, one of the most reputable regulatory bodies in the world. ASIC’s rigorous standards require brokers to maintain segregated client accounts and meet stringent financial criteria, which ensures that Go Markets operates with integrity and protects client funds.

Cyprus Securities and Exchange Commission (CySEC): For traders in Europe, Go Markets operates under CySEC regulation, which guarantees compliance with EU laws under the Markets in Financial Instruments Directive (MiFID II). This ensures transparency in trading practices and the safeguarding of client funds.

Financial Conduct Authority (FCA): Go Markets is also registered with the FCA for UK-based traders, adding another layer of oversight to its operations.

Negative Balance Protection:

In addition to regulatory protections, Go Markets offers negative balance protection across its accounts. This ensures that traders cannot lose more money than they have deposited, offering peace of mind during volatile market conditions.

Segregated Client Accounts:

To further secure client funds, Go Markets maintains segregated accounts, meaning client deposits are held separately from the company’s operational funds. This minimizes the risk of financial mismanagement or insolvency affecting client balances.

Civil Liability Insurance:

Go Markets offers an additional layer of protection to its clients through civil liability insurance. This coverage is designed to protect clients against potential losses caused by negligence, fraud, or errors by the broker. With this insurance in place, traders can feel more secure knowing that their capital is protected beyond the standard regulatory requirements.

See more Go Markets Regulatory Compliance

Compensation Fund:

As a CySEC-regulated broker, Go Markets participates in the Investor Compensation Fund (ICF), which provides compensation to clients if the broker fails to meet its obligations. This fund offers up to €20,000 per eligible client, providing a financial safety net in case of broker insolvency. This protection ensures that traders can recover part of their funds if the broker defaults, further enhancing the security of client funds.

Go Markets Account Types: Which is Right for You?

Go Markets provides several account types to cater to traders of different experience levels and trading strategies. Whether you are a novice just starting in Forex or an experienced trader looking for premium conditions, Go Markets offers accounts designed to suit your needs.

- Standard Account: The Standard Account is designed for beginner and intermediate traders who are looking for a straightforward and commission-free trading experience. Spreads start from 1.0 pips on major currency pairs, and the minimum deposit requirement is $200, making this account accessible to a wide range of traders.

- Go Plus+ Account: Tailored for more experienced traders, the Go Plus+ Account offers tighter spreads starting from 0.0 pips and a competitive commission of $3 per side per lot. This account is ideal for traders who trade in higher volumes and require lower trading costs and more precise execution.

- Islamic Account: For traders who adhere to Sharia law, Go Markets offers Islamic accounts that are swap-free. This account allows Muslim traders to engage in the markets without incurring overnight swap fees, making it compliant with Islamic principles.

Each account type comes with access to the full range of Go Markets trading platforms and instruments, giving traders the flexibility to choose the account that best fits their strategy.

See more Go Markets Account Type details

Plus+ Account

Standard Account

| Available Base Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

| Dedicated Account Manager | Yes |

| Commission | $2.50 per side on FX standard lot |

| Available Markets | Wide range of FX pairs, Shares, Indices & Commodities |

| Minimum trade size | 0.01 lots |

| Leverage | Up to 1:500 |

| Spreads | From 0.0 pips |

| Trading tools | Yes |

| EAs Allowed | Yes |

| Free VPS | Yes |

| Scalping Allowed | Yes |

| 24/5 Support | Yes |

| Available Base Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD, CHF, HKD |

| Dedicated Account Manager | Yes |

| Commission | A$0.00 |

| Available Markets | Wide range of FX pairs, Shares, Indices & Commodities |

| Minimum trade size | 0.01 lots |

| Leverage | Up to 1:500 |

| Spreads | From 1.0 pip |

| Trading tools | Yes |

| EAs Allowed | Yes |

| Free VPS | Yes |

| Scalping Allowed | Yes |

| 24/5 Support | Yes |

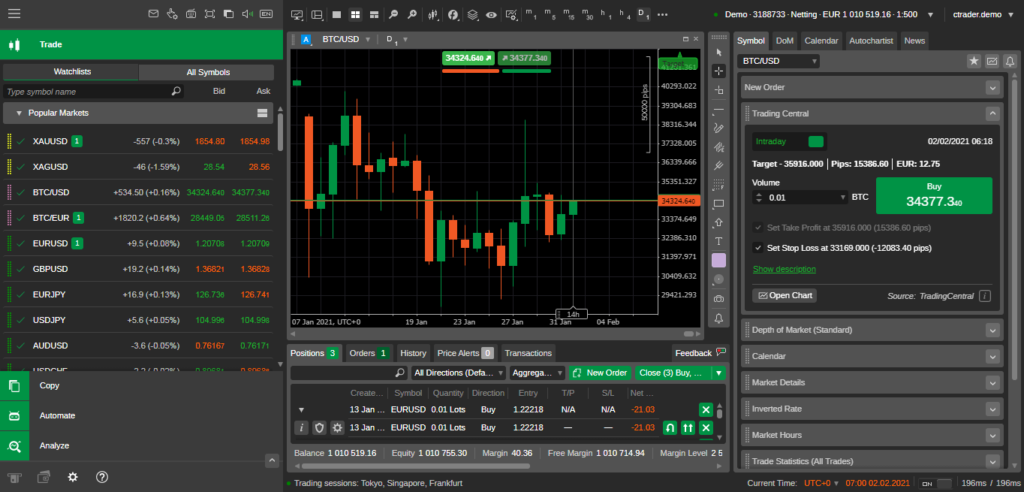

Explore Go Markets Trading Platforms: MT4, MT5, R StockTrader, and More

One of Go Markets’ major strengths is its variety of trading platforms, offering tools that cater to different trading styles and strategies. Here’s an in-depth look at the platforms available:

- MetaTrader 4 (MT4): The industry-standard trading platform, MetaTrader 4, is highly popular among both novice and experienced traders. Known for its user-friendly interface, MT4 offers advanced charting tools, customizable indicators, and the ability to execute automated trading strategies via Expert Advisors (EAs). Traders can also benefit from its fast order execution and extensive library of third-party plugins.

- MetaTrader 5 (MT5): Building on the success of MT4, MetaTrader 5 offers additional features such as more timeframes, more advanced charting tools, and access to a broader range of markets, including stocks and commodities. MT5 is perfect for traders looking for more flexibility in their trading and advanced order types.

- Go WebTrader: For traders who prefer not to download any software, Go WebTrader provides a convenient browser-based solution. This platform offers much of the functionality of MT4 and MT5 but can be accessed from any device with an internet connection, making it ideal for traders who need flexibility and ease of access.

- Mobile Trading: Go Markets also provides mobile trading options for both MT4 and MT5. These mobile apps, available for both Android and iOS, allow traders to manage their accounts, view real-time charts, and execute trades while on the go.

Go Markets Trading Instruments: How many Markets You can Trade?

Go Markets offers a wide range of trading instruments across multiple asset classes, providing traders with opportunities to diversify their portfolios. The available instruments include:

- Forex: Go Markets provides over 50 currency pairs, including major, minor, and exotic pairs. The broker’s deep liquidity ensures tight spreads and fast execution, making Forex trading cost-effective and efficient.

- Commodities: Trade popular commodities like gold, silver, crude oil, and natural gas. These products offer a great way to hedge risk or diversify beyond traditional Forex trading.

- Indices: Traders can access global indices such as the S&P 500, NASDAQ, FTSE 100, and DAX 30. Indices are an excellent way to gain exposure to entire markets or sectors, rather than individual stocks.

- Stocks and ETFs: Through the MetaTrader 5 platform, Go Markets allows traders to access a broad range of global stocks and ETFs, offering opportunities to trade the world’s leading companies.

- Cryptocurrencies: Go Markets has recently added cryptocurrencies to its list of tradable instruments, including popular assets like Bitcoin, Ethereum, and Litecoin. Cryptos provide a high-risk, high-reward trading option for those looking to capitalize on the volatility of digital currencies.

This extensive selection of trading instruments ensures that Go Markets can meet the needs of all traders, whether they are focused on Forex or looking to branch out into other financial markets.

Go Markets Spreads, Fees, and Commissions: Transparent and Competitive

Go Markets offers competitive spreads and fee structures across its different account types. Here’s what you can expect:

- Standard Account: Spreads on the Standard Account start from 1.0 pips with no additional commission fees, making it ideal for beginner traders who prefer a simple fee structure.

- Go Plus+ Account: This account features ultra-tight spreads starting from 0.0 pips. A commission of $3 per side per standard lot is charged, which is highly competitive in the industry. The tighter spreads and low commissions make this account appealing to high-volume traders.

- Pro Account: For institutional and experienced traders, the Pro Account offers even lower spreads and commissions, though specific details depend on the trading volume and instruments.

Go Markets is transparent about its swap rates for positions held overnight, and traders can easily find details about fees on their website. The broker occasionally runs promotions and rebates, allowing traders to reduce their overall costs further.

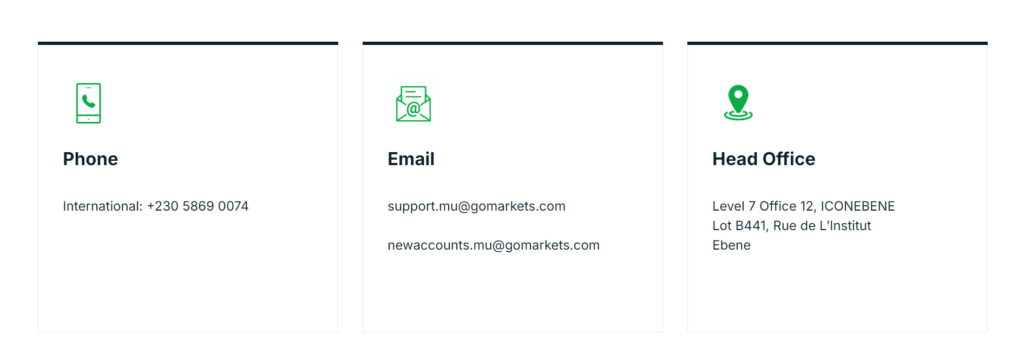

Go Markets Customer Service and Support: 24/7 Availability

Go Markets provides excellent customer support, which is available 24/7. The broker offers multiple ways to contact support:

- Live Chat: Available on the Go Markets website, live chat allows traders to get quick answers to their questions in real-time.

- Email and Phone Support: For more detailed inquiries, traders can reach out via email or phone. The response times are fast, and the support team is highly knowledgeable.

- Multilingual Support: Given its global reach, Go Markets provides support in multiple languages, ensuring that traders from various regions can communicate in their preferred language.

Traders consistently commend Go Markets for the professionalism and efficiency of its customer support team, which enhances the overall trading experience.

Educational Resources and Tools: Learning with Go Markets

Go Markets is committed to helping traders improve their skills and knowledge through a wide range of educational resources:

- Webinars and Seminars: Go Markets hosts regular webinars on trading strategies, market analysis, and platform tutorials. These webinars are suitable for traders of all skill levels and provide valuable insights into the markets.

- Video Tutorials: Comprehensive video guides on how to use the MetaTrader platforms, place trades, and analyze charts are available on the Go Markets website.

- Market Insights: Daily market updates and economic news are provided to help traders stay informed about important market events. Go Markets also offers technical and fundamental analysis to help traders make well-informed decisions.

- Demo Accounts: For beginners or experienced traders looking to test new strategies, Go Markets offers free demo accounts with virtual funds. This allows traders to practice without risking real money.

These resources help traders develop their skills and confidence, whether they are just starting or looking to refine advanced strategies.

Our Conclusion: How Go Markets Measures Up in the Forex Brokerage Industry

"Go Markets distinguishes itself as a reliable broker, combining strong regulatory compliance with a diverse range of trading instruments. The broker provides advanced platforms, competitive pricing, and tailored account options to suit traders of all levels. With comprehensive educational resources and 24/7 multilingual support, Go Markets is committed to creating a secure and supportive trading environment for those engaging in Forex and CFD markets."

whatsthebestbroker.com

try