FXPro, an FCA-regulated broker, offers MT4, MT5, cTrader, competitive spreads, diverse instruments, and strong safety, making it ideal for all traders.

Quick Overview:

| Website: | fxpro.com | |

| License: | 🇧🇸 🇨🇾 🇬🇧 🇿🇦 | |

| Established: | 2006 | |

| Broker Type: | ECN, STP, MM | |

| Instruments: | 2100+ | |

| Max Leverage: | 1:500 | |

| Min Deposit: | 100$ | |

| Fees: | Low | |

| Support: | 24/5 |

| Segregated accounts | ||

| Compensation Fund | ||

| Algo Trading | ||

| Copy Trading | ||

| PAMM Accounts | ||

| Signals | ||

| Demo Account | ||

| Cent Account | ||

| Bonuses & Contests |

- More then 2100 Instruments

- Leverage up to 1:500

- Comprehensive platform selection, including MT4, MT5, cTrader, and FXPro Edge

- Competitive pricing with transparent fee structures

- Supports automated trading (EAs)

- 24/5 multilingual customer support

- Limited Cryptocurrencies Offering

- inactivity fee is charged if no trades are made for a specific period

- Higher Minimum Deposit for Some Accounts

FXPro Review 2024: Is It the Best Forex Broker for You?

Introduction

FXPro has established itself as a globally recognized Forex and CFD broker since its inception in 2006. Over the years, the broker has expanded its services to cater to traders from all walks of life, offering a comprehensive suite of platforms and a broad range of trading instruments. FXPro is known for its reliability, strong regulatory oversight, and innovative technology. The broker has built a reputation for providing exceptional trading conditions, whether you’re a beginner or an experienced trader. This in-depth FXPro review will explore everything you need to know about the broker, from regulation and safety to trading platforms, fees, and customer support, to help you decide whether FXPro is the right broker for you in 2024.

Regulation and Safety: Is RoboForex a Safe Broker?

When choosing a broker, regulatory compliance is one of the most critical factors to consider, and FXPro takes this very seriously. FXPro is licensed by some of the world’s most respected financial regulators, providing traders with a strong sense of security and confidence.

Securities Commission of The Bahamas (SCB): FXPro Global Markets Ltd operates under the SCB’s regulation, license number SIA-F184, which is essential for international clients outside the EU or UK regions.

Financial Conduct Authority (FCA) in the UK: FXPro UK Ltd is authorized and regulated by the FCA under registration number 509956. The FCA is one of the most reputable regulators in the financial industry, known for its stringent standards to protect clients.

Cyprus Securities and Exchange Commission (CySEC): FXPro Financial Services Ltd is regulated by CySEC under license number 078/07. Being based in Cyprus, this regulation allows FXPro to serve clients across the European Economic Area (EEA).

Financial Sector Conduct Authority (FSCA) in South Africa: FXPro is authorized under FSCA license number 45052, allowing it to offer its services to traders in South Africa.

The multi-regulatory framework ensures that FXPro operates under a strict set of rules that prioritize transparency, fair dealing, and client protection. Additionally, FXPro segregates client funds from corporate accounts, ensuring that traders’ capital is not used for operational purposes. This step adds another layer of protection, as clients’ funds are shielded from any financial difficulties the broker may face.

Civil Liability Insurance:

In addition to regulatory protections, FXPro offers Civil Liability insurance with coverage up to £1,000,000. This insurance policy provides an extra layer of security for clients, protecting them against potential financial losses due to negligence, errors, or fraud. This coverage goes beyond what is required by regulatory bodies and demonstrates FXPro’s commitment to safeguarding its clients’ funds and maintaining the highest level of operational integrity.

See more FXPro Regulatory Compliance

Compensation Fund:

FXPro provides client protection through its participation in compensation schemes. For UK clients, FXPro is a member of the Financial Services Compensation Scheme (FSCS), which covers eligible clients up to £85,000 in the event that the broker faces financial difficulties. For clients within the EU, FXPro is a member of the Investor Compensation Fund (ICF), which protects up to €20,000 per client. These compensation funds ensure that client funds are protected, even in the worst-case scenario where the broker becomes insolvent.

Verify My Trade Certification:

FXPro also holds the Verify My Trade (VMT) certification, which further enhances its commitment to transparency and trade execution quality. This certification requires FXPro to regularly submit a sample of its trades for independent auditing, ensuring that its execution quality meets industry standards. The VMT certification is awarded by the Financial Commission, an independent organization that resolves disputes between brokers and their clients, and it serves as a benchmark for fair and consistent order execution.

FXPro Account Types: Which is Right for You?

FXPro offers a variety of account types to cater to different trading styles, preferences, and experience levels. Each account type has its own set of features and benefits, allowing traders to choose one that best suits their needs.

- MT4/MT5 Accounts: These are the most popular account types, offering commission-free trading with spreads starting from 1.4 pips. They are ideal for traders who prefer the classic MetaTrader platforms and want to avoid commissions. The MT4 and MT5 platforms offer a wide range of trading tools, charting features, and automation capabilities through Expert Advisors (EAs).

- cTrader Accounts: For traders seeking raw spreads and direct market access, FXPro’s cTrader account is the best option. It features spreads starting from 0 pips, but traders pay a commission of $45 per $1 million traded. cTrader is renowned for its speed and efficiency, making it an excellent choice for scalpers and high-frequency traders.

- FXPro Edge: FXPro’s proprietary trading platform, FXPro Edge, is designed for UK clients who are interested in spread betting. Spread betting allows traders to speculate on the price movements of financial instruments without actually owning the underlying asset. This account is commission-free, with variable spreads, and offers leverage up to 1:200.

- Islamic Accounts: For traders who adhere to Sharia law, FXPro offers swap-free Islamic accounts. These accounts do not incur interest on overnight positions, making them compliant with Islamic finance principles.

Each of these accounts provides leverage up to 1:200 for international clients and up to 1:30 for EU and UK clients, depending on the regulation under which they operate. The wide variety of account options ensures that FXPro can accommodate both retail traders and professionals with diverse trading needs.

View More about FXPro Trading Account Type

See more FXPro Account Type details

Available Soon

Available Soon

Available Soon

Available Soon

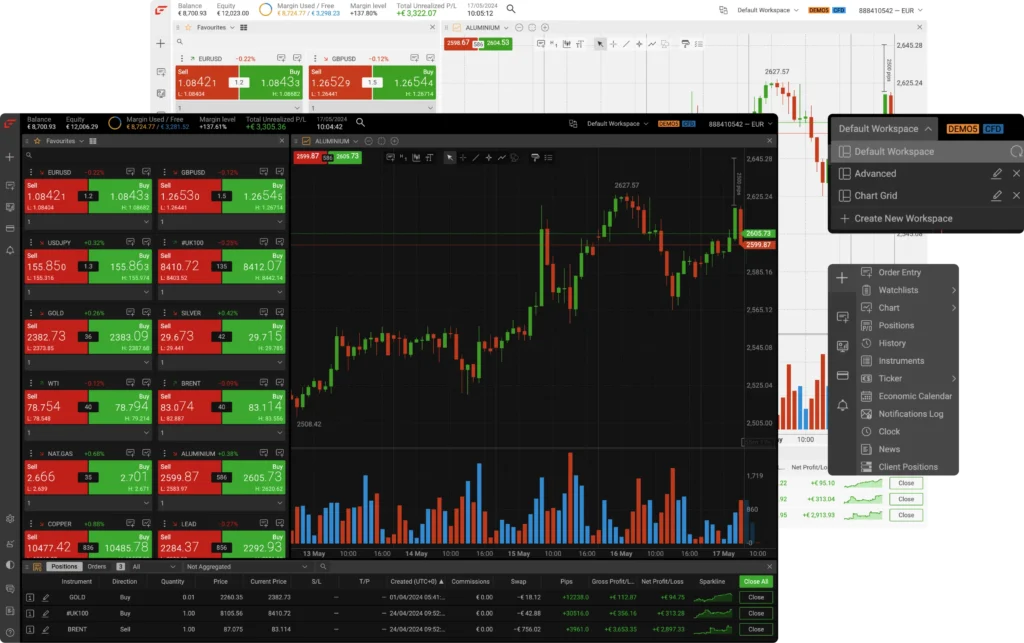

Explore FXPro Platforms: MT4, MT5, cTrader, and More

One of FXPro’s strongest selling points is the variety of trading platforms it offers. These platforms are designed to meet the needs of traders with different preferences, from those who prefer classic trading software like MetaTrader to those who want more advanced tools like cTrader.

- MetaTrader 4 (MT4): MT4 is widely regarded as the gold standard in Forex trading platforms. It offers robust charting tools, technical analysis features, and the ability to automate trades using Expert Advisors (EAs). MT4 is suitable for both beginner and experienced traders, providing a user-friendly interface and access to a wide range of indicators and customization options.

- MetaTrader 5 (MT5): MT5 is the more advanced successor to MT4, offering additional features such as more timeframes, more order types, and a greater variety of instruments. It is ideal for traders who want more flexibility and analytical tools.

- cTrader: cTrader is a platform designed for traders who prefer direct market access (DMA) and raw spreads. It offers fast execution, advanced order types, and access to deep liquidity. cTrader is especially popular among scalpers and high-frequency traders who need fast order execution with minimal slippage.

- FXPro Edge: FXPro’s proprietary web-based platform is designed for ease of use and accessibility. It is perfect for beginners and UK traders who are interested in spread betting. The platform allows traders to manage their trades efficiently without the need for software downloads.

FXPro also offers mobile apps for both Android and iOS devices, ensuring that traders can access their accounts and manage their positions on the go. The mobile platforms are fully equipped with real-time charts, order execution, and account management features.

FXPro Trading Instruments: How Many Markets Can You Trade?

FXPro offers an extensive range of over 250 trading instruments across various asset classes, making it one of the most versatile brokers in the industry. Traders can choose from:

- Forex: FXPro provides access to over 70 currency pairs, including major, minor, and exotic pairs. The wide variety of currency pairs makes it suitable for traders who want to diversify their Forex portfolio or take advantage of global economic trends.

- Shares and Indices: FXPro offers CFDs on global stocks and major indices like the S&P 500, NASDAQ, FTSE 100, and more. This allows traders to speculate on the performance of the world’s largest companies and stock markets.

- Commodities: Commodities such as gold, silver, crude oil, and natural gas are available for trading. These assets are popular among traders who want to hedge against inflation or diversify their portfolios.

- Futures: FXPro offers a range of futures contracts, providing opportunities to speculate on the future price movements of commodities, indices, and currencies.

- Cryptocurrencies: FXPro offers CFDs on popular cryptocurrencies such as Bitcoin, Ethereum, Ripple, and Litecoin. Cryptocurrency trading has grown in popularity, and FXPro’s offering allows traders to gain exposure to these digital assets without owning them.

FXPro Spreads, Fees, and Commissions: Transparent and Competitive

FXPro is known for its competitive pricing structure, although the exact fees and spreads depend on the platform and account type.

- MT4/MT5 Accounts: These accounts operate on a spread-only basis, meaning traders do not pay commissions. Spreads start from 1.4 pips on major currency pairs, such as EUR/USD, making them suitable for traders who want simple, commission-free pricing.

- cTrader Accounts: cTrader accounts offer raw spreads starting from 0 pips, but traders pay a commission of $45 per $1 million traded. This pricing structure is popular among traders who prioritize low spreads and are willing to pay a small commission for more precise execution.

- Swap Fees: Traders who hold positions overnight will incur swap fees, which vary depending on the instrument and market conditions. For traders who prefer not to deal with swaps, FXPro offers Islamic accounts that do not charge overnight interest.

- Spreads and Fees on Other Assets: Spreads on other assets like indices, commodities, and cryptocurrencies vary depending on market conditions. FXPro is transparent about its fees, and detailed information is available on the broker’s website, ensuring traders are well-informed about the costs associated with their trades.

FXPro Customer Service and Support: 24/5 Availability

FXPro has a solid reputation for providing excellent customer support. The broker’s support team is available 24 hours a day, 5 days a week, across multiple channels, including:

FXPro Academy: The broker also offers an educational platform called FXPro Academy, which includes video tutorials, webinars, and articles on various trading topics. This resource is especially beneficial for beginner traders who want to improve their understanding of Forex and CFD trading.

Live Chat: FXPro offers live chat support in over 27 languages, ensuring that clients from various regions can get assistance in their preferred language.

Email and Phone Support: Traders can also contact FXPro via email or phone, and the broker is known for its quick response times and helpful customer service agents.

Educational Resources and Tools: Learning with FXPro

ducation is a key component of FXPro’s offering, and the broker provides a wide range of educational resources to help traders at all levels improve their skills.

- Trading Academy: FXPro Academy offers a range of educational content, including articles, videos, and webinars, covering everything from basic trading concepts to advanced strategies.

- Market News and Analysis: FXPro provides daily and weekly market analysis reports, giving traders insights into current market trends and potential trading opportunities.

- Demo Accounts: FXPro offers demo accounts on all its platforms, allowing traders to practice strategies or get familiar with the broker’s offering without risking real money.

Our Conclusion: How FXPro Measures Up in the Forex Brokerage Industry

"FXPro stands out as one of the most reliable and versatile Forex brokers in the industry. With its strong regulatory framework, wide variety of account types and platforms, competitive pricing, and exceptional customer support, FXPro is well-suited to traders of all experience levels. Whether you're a beginner looking for an easy-to-use platform or a professional trader seeking raw spreads and fast execution, FXPro has something to offer. The broker’s commitment to security, transparency, and continuous improvement makes it a top choice for traders in 2024."

whatsthebestbroker.com