FXCentrum provides diverse instruments, flexible accounts, and strong support with competitive fees, offering a solid trading experience despite basic regulation.

Quick Overview:

| Website: | fxcentrum.com | |

| License: | FSA | |

| Established: | 2019 | |

| Broker Type: | ECN, VIP | |

| Instruments: | 381+ | |

| Max Leverage: | 1:1000 | |

| Min Deposit: | 10$ | |

| Fees: | Low | |

| Support: | 24/5 |

| Segregated accounts | ||

| Compensation Fund | ||

| Algo Trading | ||

| Copy Trading | ||

| PAMM Accounts | ||

| Signals | ||

| Demo Account | ||

| Cent Account | ||

| Bonuses & Contests |

- beginner-friendly accounts (Cent) to advanced (ECN, VIP)

- Leverage up to 1:1000

- Low minimum deposit cent accounts start from $10

- Support for MetaTrader 4 (MT4)

- Mobile and Web-based trading platforms

- 24/5 multilingual customer support

- Offers webinars, trading courses, and demo accounts

- FSA is not as stringent as other top-tier regulatory bodies (FCA, CySEC)

- No compensation fund

- withdrawal methods may incur fees

- Limited cryptocurrency offering

- No 24/7 customer support

FXCentrum Review 2024: Is It the Best Forex Broker for You?

Introduction

Launched in 2021, FXCentrum has rapidly positioned itself as a competitive broker in the Forex and CFD trading market. Offering a range of trading instruments, competitive fees, multiple account types, and intuitive platforms, FXCentrum seeks to serve both beginner and professional traders. The broker has garnered attention for its focus on flexibility, user-friendly platforms, and a growing suite of educational resources.

While the platform offers a range of features, the critical question remains: is FXCentrum the right broker for your specific needs? In this review, we’ll delve deep into FXCentrum’s regulatory framework, trading conditions, platform options, fees, and customer support, to help you determine whether this broker aligns with your trading strategy and goals.

Regulation and Safety: Is FXCentrum a Trustworthy Broker?

One of the primary concerns when choosing a broker is the security and regulation under which they operate. FXCentrum is regulated by the Financial Services Authority (FSA) of St. Vincent and the Grenadines, under license number 24390 IBC 2019. While this regulation provides a basic level of oversight, it’s important to note that the FSA is not considered as stringent as other financial regulatory bodies, such as the FCA (UK) or CySEC (Cyprus).

That said, FXCentrum employs several important safety measures to safeguard client funds and data:

- Segregated Accounts: Client funds are kept separate from the broker’s operational accounts, reducing the risk of misuse or insolvency.

- SSL Encryption: The platform uses secure encryption to protect sensitive information and transactions, ensuring that client data remains safe from potential breaches.

- Negative Balance Protection: FXCentrum offers negative balance protection, meaning clients cannot lose more than their account balance, a crucial feature in highly volatile markets.

While FXCentrum’s regulation may not inspire the highest confidence when compared to top-tier regulators, the broker does take significant steps to protect its clients and maintain transparency. However, traders looking for added security may prefer brokers regulated by stronger regulatory bodies.

Civil Liability Insurance:

FXCentrum provides civil liability insurance to its clients as an additional layer of security. This insurance covers potential financial losses incurred due to negligence, fraud, or omissions by the broker. Though FXCentrum’s exact insurance policy details may vary, such a program helps protect clients against unforeseen financial issues that could arise from broker errors. This coverage offers peace of mind, knowing that the broker has a backup plan to safeguard your funds from legal or operational mishaps.

See more FXCentrum’s Regulatory Compliance

Compensation Fund:

While FXCentrum is regulated by the FSA, it does not participate in any well-known compensation fund similar to those offered by brokers regulated by European bodies like CySEC’s Investor Compensation Fund (ICF). Compensation funds protect clients in case the broker becomes insolvent, reimbursing traders up to a specific limit. This is an important safety feature often seen with brokers regulated in more heavily regulated jurisdictions, and the absence of a similar fund may be a consideration for traders seeking higher levels of protection.

Verify My Trade Certification:

FXCentrum has taken additional steps to maintain transparency by obtaining the Verify My Trade (VMT) certification. This independent certification ensures that the broker’s trade execution quality meets industry standards. FXCentrum submits a sample of trades for regular audits to VMT, where the data is analyzed to ensure that execution quality is up to par. This certification helps bolster trader confidence by guaranteeing that their orders are executed at competitive prices, reducing the risk of unfair trading practices

FXCentrum Account Types: A Range to Suit Every Trader

FXCentrum offers an impressive variety of account types, catering to different levels of experience, risk appetite, and trading preferences. Whether you’re just starting or are an experienced trader, FXCentrum provides multiple options to ensure that your account fits your trading style:

- Standard Account: This is the most common account type, suitable for beginners and intermediate traders. It requires a relatively low minimum deposit of $100, offers competitive spreads from 1.5 pips, and has no commissions. With a maximum leverage of 1:1000, this account allows traders to manage larger positions with a smaller capital base.

- ECN Account: For traders looking for direct market access (DMA), the ECN account provides tight spreads starting from 0 pips, but with commissions of $6 per lot traded. With a minimum deposit of $500, it’s ideal for experienced traders who seek low-cost trading in exchange for volume-based fees. The ECN account is known for faster execution and greater transparency since trades are routed directly to the market.

- Cent Account: The Cent account is perfect for those who are new to Forex trading or for traders who want to test their strategies with minimal risk. With a minimum deposit of just $10, traders can access the market with micro-lots, making this an ideal way to practice and build confidence without putting significant capital at risk. Spreads start from 2 pips, and there are no commissions.

- VIP Account: This account type is tailored for high-volume or professional traders who require premium trading conditions. With a minimum deposit of $10,000, the VIP account offers spreads starting from 0.5 pips, along with priority customer service. The trading environment here is optimized for larger capital traders looking to execute big trades under favorable conditions.

Islamic Accounts: FXCentrum also provides swap-free options for traders who adhere to Sharia law, making it possible for Muslim traders to participate without incurring overnight swap fees.

The variety in account types ensures that FXCentrum appeals to traders across the spectrum, from casual retail investors to high-net-worth individuals and professionals.

See more FXCentrum’s Account Type details

Margin Bonus 100%

Floating Bonus 25%

Scalping Margin 50%

| Top up Bonus for all deposits | 100% – up to 100 000 USD |

| Minimum deposit | 10 USD |

| Minimum lot position | 0,01 |

| Cashback | 2 USD per 100 000 volume (in example it is 2 USD per 1 lot trade on forex) |

| Leverage on the account | 1.1000 |

| Copytrading | Allowed |

| Withdrawal classic | Up to 48h on working days Verified KYC 20 USD per withdrawal |

| Withdrawal VIP | Available |

| Bonus for all deposits | Floating Bonus 25% maximum 10 000 USD (it means if you deposit 10x you get 10x – 25%) |

| Minimum deposit | 10 USD |

| Minimum lot position | 0,25 |

| Leverage on the account | 1:500 |

| Copytrading | Allowed |

| Cashback | No, only on margin accounts |

| Withdrawal classic | Up to 48h on working days 20 USD per withdrawal |

| Withdrawal VIP | Available |

| Top up Bonus for all deposits | 50% – up to 10 000 USD |

| Minimum deposit | 1000 USD if you deposit below 1000 USD per deposit, then there is no bonus credited nor will be credited manually |

| Cashback | 5 USD per 100 000 volume (in example it is 5 USD per 1 lot traded on forex) |

| Monthly swapback | 5% if deposits in a month are 5 000 USD. 10% if deposits in a month are 10 000 USD |

| Minimum lot position | 0,5 (5 on indices) |

| Leverage on the account | 1:200 |

| Copytrading | Allowed |

| Scalping | Allowed without limits |

| Withdrawal classic | Up to 48h on working days Verified KYC 5% (min 100 USD per withdrawal) |

| Withdrawal VIP | Available |

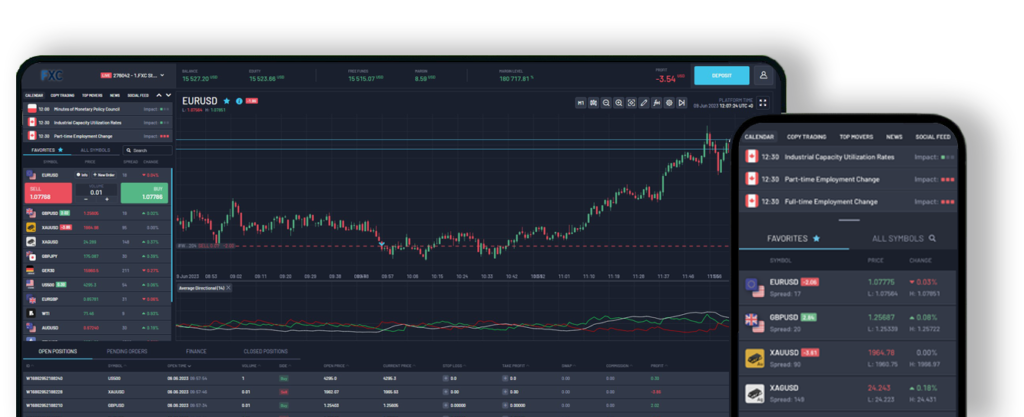

Explore FXCentrum Trading Platforms: MetaTrader 4 and More

FXCentrum offers traders a choice of reliable and intuitive platforms, ensuring that everyone—from beginners to advanced traders—can find a suitable option:

- MetaTrader 4 (MT4): FXCentrum offers the ever-popular MT4 platform, a well-regarded trading solution recognized globally for its powerful charting tools, extensive technical analysis capabilities, and support for automated trading via Expert Advisors (EAs). MT4 remains a go-to platform for many Forex and CFD traders due to its flexibility, reliability, and the ability to customize trading strategies.

- WebTrader: For those who prefer trading without downloading software, FXCentrum’s WebTrader offers a user-friendly, browser-based solution. This platform allows traders to access their accounts from any device with an internet connection. It offers all the essential features needed for trading, including real-time charts, various indicators, and one-click trading.

- Mobile Trading Apps: FXCentrum also provides dedicated mobile trading apps for both iOS and Android devices. These apps ensure that traders can execute trades, manage their accounts, and stay up to date with market movements even when on the go. The mobile platforms include essential functionalities such as charting tools, access to multiple assets, and real-time price feeds.

Each of these platforms provides seamless access to a variety of financial markets, ensuring that traders have the tools they need to execute their strategies effectively, whether from a desktop, laptop, or mobile device.

FXCentrum Trading Instruments: A Diverse Selection

FXCentrum excels when it comes to offering a broad range of trading instruments. This diversity allows traders to diversify their portfolios across several asset classes:

- Forex: FXCentrum provides access to over 50 currency pairs, including majors (such as EUR/USD), minors, and exotics. This variety gives traders ample opportunities to trade in both highly liquid and more niche markets.

- Commodities: The broker offers commodities trading, including popular precious metals like gold and silver, as well as energy products like oil and natural gas. Commodity trading can provide excellent opportunities during times of economic uncertainty or inflation.

- Indices: Traders can speculate on the performance of some of the world’s largest stock indices, including the NASDAQ, S&P 500, and FTSE 100. Indices are often used by traders to diversify their portfolios or hedge against stock market volatility.

- Stocks: FXCentrum offers CFDs on major stocks from global markets, enabling traders to take positions on companies from the U.S., Europe, and Asia without owning the underlying shares. CFDs on stocks can be particularly appealing for those looking to profit from both rising and falling markets.

- Cryptocurrencies: As cryptocurrencies continue to gain popularity, FXCentrum provides traders with access to the most traded digital assets, including Bitcoin, Ethereum, and Ripple. This allows traders to speculate on the price movements of these highly volatile assets, potentially yielding significant returns.

This diverse range of tradable assets ensures that FXCentrum can meet the needs of traders looking to engage in various markets, whether they prefer the currency market, the stock market, or the fast-paced world of cryptocurrency.

FXCentrum Spreads, Fees, and Commissions: Transparent and Competitive

FXCentrum’s fee structure is transparent, with spreads and commissions varying based on the account type:

- Standard Account: Spreads start from 1.5 pips, with no commissions, making it a suitable option for casual traders who prefer a simple fee structure.

- ECN Account: Spreads can be as low as 0 pips, but a commission of $6 per lot traded applies. This makes the ECN account attractive to more experienced traders who prefer tighter spreads and are comfortable with a commission-based model.

- Cent Account: Spreads on the Cent account start from 2 pips, with no commissions. This account type is geared towards those looking to trade with smaller sums.

- VIP Account: For high-volume traders, the VIP account offers competitive spreads starting from 0.5 pips, with no commissions. This provides a premium trading environment for professional traders seeking the best conditions..

In addition to its standard pricing, FXCentrum frequently offers promotions and cashback incentives, which can enhance the trading experience and make the broker even more competitive, especially for active traders.

FXCentrum Customer Support: Available When You Need It

FXCentrum offers 24/5 customer support via live chat, email, and phone. Although support is not available 24/7, traders still benefit from comprehensive service during the trading week. The broker’s customer service team is multilingual, which ensures that traders from various regions can communicate in their preferred language. Additionally, FXCentrum provides a robust FAQ section on its website, covering a wide range of common queries and issues.

Reviews of FXCentrum’s customer service generally highlight quick response times and helpful solutions, although some traders may miss the around-the-clock support that other brokers offer.

Educational Resources: A Commitment to Trader Development

FXCentrum places a strong emphasis on educating its traders, offering an array of educational resources designed to help both beginners and experienced traders improve their knowledge and skills:

- Webinars: Regular webinars cover a variety of topics, from market analysis and trading strategies to platform tutorials and risk management. These live sessions allow traders to ask questions and interact with professional traders and analysts.

- Trading Courses: FXCentrum offers structured courses for traders of all experience levels. Beginners can learn the basics of Forex trading, while more advanced traders can refine their skills.

- E-books and Articles: The broker provides a selection of free e-books and articles covering essential trading concepts, technical analysis, and psychological aspects of trading.

- Demo Accounts: Traders can practice their strategies using a risk-free demo account, which simulates live trading conditions. This is especially beneficial for those new to trading or for experienced traders looking to test new strategies.

Our Conclusion: Is FXCentrum a Good Fit for You?

"FXCentrum stands out for its extensive range of trading instruments, flexible account types, and user-friendly platforms. With competitive pricing, leverage up to 1:1000, and dedicated educational resources, the broker provides a supportive environment for traders of all experience levels. Although its regulation may not be top-tier, FXCentrum focuses on transparency and client protection, making it a solid choice for those looking to trade Forex and CFDs."

whatsthebestbroker.com