Founded in 2009 in Melbourne, Australia, EightCap’s mission is to deliver exceptional financial services to its clients through innovative trading solutions.

Quick Overview:

| Website: | eightcap.com | |

| License: | 🇨🇾 CySec 🇬🇧 FCA 🇦🇺 ASIC | |

| Established: | 2009 | |

| Broker Type: | ECN, STP | |

| Instruments: | 800+ | |

| Max Leverage: | 1:500 | |

| Min Deposit: | 100$ | |

| Fees: | Low | |

| Support: | 24/5 |

| Segregated accounts | ||

| Compensation Fund | ||

| Algo Trading | ||

| Copy Trading | ||

| PAMM Accounts | ||

| Signals | ||

| Demo Account | ||

| Cent Account | ||

| Bonuses & Contests |

- More then 800 Instruments

- Leverage up to 1:500

- Comprehensive platform selection, including MT4, MT5, and TradingView

- Competitive pricing with transparent fee structures

- 24/5 multilingual customer support

- Zero deposit fees

- Limited cryptocurrency offerings

- Some withdrawal methods incur fees

- Limited customer support hours

EightCap Review 2024: Is It the Best Forex Broker for You?

Introduction

Since its inception in 2009, EightCap has established itself as a prominent player in the world of online trading. With access to over 800 financial instruments across Forex, commodities, indices, cryptocurrencies, and shares, EightCap offers a comprehensive trading experience. Known for its competitive pricing structure, advanced trading platforms, and robust regulatory framework, the broker appeals to both novice and experienced traders. This detailed review covers everything you need to know about EightCap, from its account types and trading platforms to its regulatory compliance and customer support.

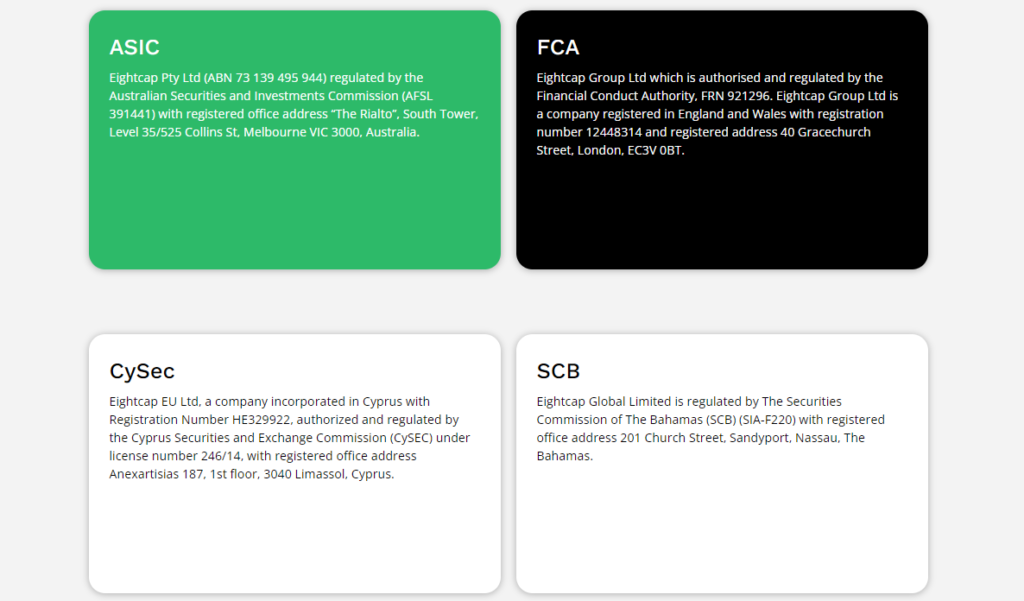

Regulation and Safety: Is EightCap a Safe Broker?

One of the most crucial aspects of any broker is its regulatory standing, as it directly impacts the safety of client funds and overall trustworthiness. EightCap excels in this area by operating under several reputable financial regulators worldwide.

ASIC Regulation

EightCap Pty Ltd is regulated by the Australian Securities and Investments Commission (ASIC) under AFSL number 391441. ASIC is one of the most trusted financial regulators globally, known for its stringent oversight of the financial industry. Traders under this jurisdiction benefit from the high levels of security provided by ASIC, including the requirement that brokers hold client funds in segregated accounts. This ensures that client funds are separated from the broker’s operational funds, protecting traders from the risk of insolvency or misuse of their capital.

FCA Regulation

In the UK, EightCap Group Ltd is authorized and regulated by the Financial Conduct Authority (FCA) under FRN 921296. The FCA is renowned for its strict regulatory standards, including requirements for financial transparency, the safeguarding of client funds, and stringent capital adequacy rules. Importantly, EightCap’s FCA-regulated clients are covered by the Financial Services Compensation Scheme (FSCS), which protects deposits up to £85,000 in the unlikely event of broker insolvency.

CySEC Regulation

EightCap EU Ltd is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 246/14. CySEC is widely recognized across the European Union and is known for enforcing strict standards related to client fund protection and broker transparency. Under CySEC regulations, traders are also protected by the Investor Compensation Fund (ICF), which provides compensation of up to €20,000 per client if the broker faces financial difficulties.

SCB Regulation

For international clients, EightCap Global Limited is regulated by the Securities Commission of The Bahamas (SCB) under license number SIA-F220. The SCB ensures that brokers adhere to internationally accepted standards of financial practice, offering a secure trading environment for clients outside of Europe and Australia.protects clients’ funds up to £85,000 in the event of broker insolvency, providing an added layer of security for traders.

Segregated Accounts and Advanced Security Measures

Across all jurisdictions, EightCap maintains segregated accounts to ensure that client funds are kept separate from operational capital. This is a regulatory requirement in many regions and provides peace of mind that your funds cannot be used for the broker’s day-to-day operations. Additionally, EightCap employs advanced security measures like SSL encryption to safeguard your personal and financial data during transactions.

Civil Liability Insurance:

On top of the regulatory protections, EightCap also offers civil liability insurance, which provides coverage against potential financial losses due to errors, omissions, fraud, or negligence on the part of the broker. This further reinforces the broker’s commitment to client safety and adds an extra layer of protection for traders.

See more EightCap Regulatory Compliance

Compensation Fund:

In line with CySEC’s regulatory requirements, EightCap offers the Investor Compensation Fund (ICF) to its EU clients. This compensation scheme ensures that, in the unlikely event of broker insolvency, clients can claim compensation of up to €20,000. This fund provides an additional safety net for European traders.

EightCap Account Types: Which is Right for You?

EightCap offers two primary types of accounts, each designed to meet different trader needs. Whether you’re a beginner or an advanced trader, the broker provides an account that aligns with your goals and trading style.

Standard Account

The Standard Account is designed for traders who prefer a simple, commission-free trading experience. It offers spreads starting from 1 pip, and the cost of trading is built into the spread. This account type is ideal for beginner traders who wish to avoid dealing with commission fees and prefer a more straightforward pricing model. With access to over 800 instruments across Forex, indices, commodities, cryptocurrencies, and shares, the Standard Account provides a broad range of opportunities for traders.

Raw Account

For more experienced traders, the Raw Account offers tighter spreads starting from 0 pips but comes with a commission of $3.50 per lot per side. This account type is better suited for professional traders or those who prefer a more transparent fee structure and are comfortable with paying commissions in exchange for ultra-low spreads. The Raw Account also offers access to the same range of over 800 instruments and is ideal for high-frequency traders, scalpers, or those employing algorithmic strategies.

Leverage

EightCap offers highly flexible leverage options, up to 1:500 for non-EU clients. This high level of leverage allows traders to control larger positions with a smaller amount of capital, which can potentially magnify gains. However, EU clients are subject to ESMA regulations, which cap leverage at 1:30 for retail clients, ensuring that European traders are protected from the risks associated with high leverage(.

See more EightCap Account Type details

Raw Account

Standard Account

TradingView Account

| Account Base Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD |

| Spreads | 0.0 pips |

| Available Instruments | 800+ |

| Commission | Each side: 3.5 AUD, USD, NZD, SGD, CAD | 2.25 GBP | 2.75 EUR per standard lot traded |

| Minimum Deposit | $100 |

| Min/Max trade size | 0.01 lots / 100 lots |

| Margin call level | 80% |

| Stop out level | 50% |

| Scalping | Allowed |

| Account Base Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD |

| Spreads | 1.0 pips |

| Available Instruments | 800+ |

| Commission | No Commission* (Shares include commission) |

| Minimum Deposit | $100 |

| Min/Max trade size | 0.01 lots / 100 lots |

| Margin call level | 80% |

| Stop out level | 50% |

| Scalping | Allowed |

| Account Base Currencies | AUD, USD, EUR, GBP, NZD, CAD, SGD |

| Spreads | 1.0 pips |

| Available Instruments | 800+ |

| Commission | No Commission* (Shares include commission) |

| Minimum Deposit | $100 |

| Min/Max trade size | 0.01 lots / 100 lots |

| Margin call level | 80% |

| Stop out level | 50% |

| Scalping | Allowed |

Explore RoboForex Trading Platforms: MT4, MT5, R StockTrader, and More

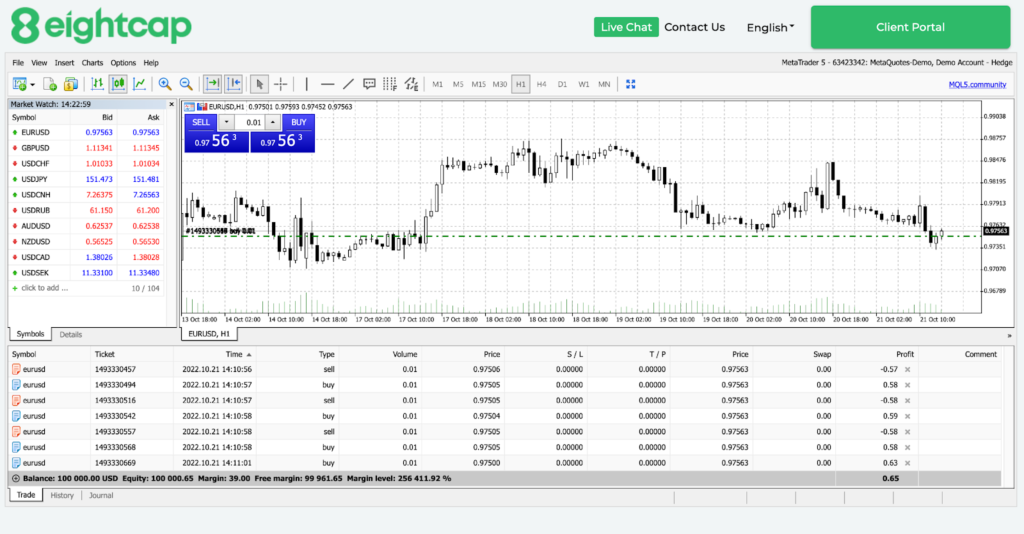

EightCap provides access to two of the most powerful and widely used trading platforms in the industry—MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are known for their advanced charting tools, extensive support for technical indicators, and the ability to run automated trading strategies through Expert Advisors (EAs).

MetaTrader 4 (MT4)

MT4 remains the go-to platform for many Forex traders. It offers a user-friendly interface, making it suitable for both beginners and experienced traders. Key features of MT4 include advanced charting capabilities, multiple timeframes, and a wide range of technical indicators. MT4 also supports automated trading through EAs, allowing traders to deploy pre-programmed strategies.

MetaTrader 5 (MT5)

MT5 is an upgraded version of MT4, offering additional features such as more order types, more timeframes, and support for a broader range of financial instruments, including stocks and commodities. MT5 is ideal for traders who require more advanced tools and want to trade across multiple asset classes on one platform.

TradingView Integration

In addition to MT4 and MT5, EightCap offers TradingView integration, enabling traders to take advantage of TradingView’s advanced charting tools and social trading features. This integration provides a seamless trading experience for those who prefer TradingView’s intuitive interface and robust analytical capabilities.

EightCap Trading Instruments: How many Markets You can Trade?

EightCap offers access to a wide range of financial markets, allowing traders to diversify their portfolios and take advantage of opportunities across different asset classes.

Forex

With over 40 currency pairs available, including major, minor, and exotic pairs, Forex trading at EightCap provides ample opportunities for traders to speculate on global currencies. The broker’s competitive spreads and fast execution make it an attractive option for Forex traders.

Commodities

EightCap offers trading in key commodities like gold, silver, oil, and natural gas. Commodities trading can serve as a hedge against inflation or a speculative opportunity based on global market trends.

Indices

Traders can access major global indices such as the S&P 500, NASDAQ, FTSE 100, and DAX 30, offering opportunities to speculate on the broader performance of global economie.

Cryptocurrencies

EightCap stands out for its extensive offering of cryptocurrency CFDs. With access to popular cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Litecoin (LTC), the broker provides a robust platform for crypto traders looking to capitalize on the volatility of digital assets.

EightCap Spreads, Fees, and Commissions: Transparent and Competitive

EightCap prides itself on offering competitive and transparent fees across all account types. Here’s a breakdown:

- Standard Account: Traders using the Standard Account benefit from commission-free trading, with spreads starting from 1 pip.

- Raw Account: For traders using the Raw Account, spreads can drop to 0 pips, with a commission of $3.50 per lot per side.

EightCap is transparent about its swap rates and overnight fees, ensuring that traders can easily understand their costs. Additionally, there are no deposit or withdrawal fees, though third-party charges may apply depending on your payment provide.

EightCap Customer Support: Reliable and Available

EightCap provides excellent customer support, available 24/5 via live chat, email, and phone. The support team is multilingual and responsive, ensuring that traders can get help whenever needed. Additionally, the broker offers an extensive FAQ section and educational resources through EightCap Labs, which provides webinars, articles, and market insights.

Educational Resources and Tools: Learning with EightCap

EightCap offers a range of educational materials designed to enhance traders’ knowledge and improve their trading skills. These resources include:

- Webinars: Regularly scheduled webinars cover various topics such as market analysis, trading strategies, and platform tutorials. These sessions are conducted by industry experts and are ideal for traders looking to deepen their understanding of the markets.

- Trading Guides: EightCap provides detailed guides on essential trading concepts like risk management, technical analysis, and fundamental analysis. These are particularly useful for beginners who need a strong foundation in trading theory.

- Market Analysis: EightCap offers daily market updates, technical analysis reports, and economic news summaries to keep traders informed of key market events and trends.

Additionally, EightCap integrates Trading Central, a popular third-party tool that provides advanced technical analysis, trade recommendations, and sentiment analysis. This tool is beneficial for traders who rely heavily on data-driven decision-making.

Our Conclusion: How EightCap Measures Up in the Forex Brokerage Industry

EightCap has successfully positioned itself as a reliable and versatile broker, offering a wide range of financial instruments, competitive fees, and top-tier trading platforms. With strong regulatory oversight from ASIC, FCA, CySEC, and SCB, along with additional protections like segregated accounts and civil liability insurance, traders can feel confident that their funds are safe.Whether you're a beginner looking for a simple, commission-free account or an experienced trader seeking low spreads and advanced trading tools, EightCap provides a robust trading environment that caters to all levels. With its commitment to transparency, excellent customer support, and innovative features like TradingView integration, EightCap is well-suited for traders seeking a secure and feature-rich broker in 2024.

whatsthebestbroker.com