Trade Nation, regulated by ASIC, FCA, SCB, and FSCA, offers reliable trading since 2014 with competitive spreads, no commissions, and advanced platforms like TradingView for a solid experience.

Quick Overview:

| Website: | tradenation.com | |

| License: | 🇬🇧 🇦🇺 🇿🇦 🇸🇨 🇧🇸 | |

| Established: | 2015 | |

| Broker Type: | ECN, MM | |

| Instruments: | 1000+ | |

| Max Leverage: | 1:200 | |

| Min Deposit: | 0$ | |

| Fees: | Very Low | |

| Support: | 24/7 |

| Segregated accounts | ||

| Compensation Fund | ||

| Algo Trading | ||

| Copy Trading | ||

| PAMM Accounts | ||

| Signals | ||

| Demo Account | ||

| Cent Account | ||

| Bonuses & Contests |

- Regulated by reputable financial governing bodies (FCA, ASIC, SCB)

- More then 1000 Instruments

- Leverage up to 1:200

- Best spreads and trading condition in the market

- Trading View available

- Negative Balance Protection

- Limited Cryptocurrency Options

- Limited information on customer support options

Trade Nation Review 2024: Is It the Best Forex Broker for You?

Introduction

Founded in 2014, Trade Nation has emerged as a prominent forex broker known for its transparent pricing, robust trading platforms, and commitment to client success. The broker is designed to cater to a diverse clientele, ranging from novice traders to seasoned professionals. This comprehensive review of Trade Nation will delve into the broker’s regulatory framework, account types, trading platforms, spreads, fees, customer support, and educational resources, helping you determine if Trade Nation is the right choice for your trading needs.

Regulation and Safety: Is Trade Nation a Safe Broker?

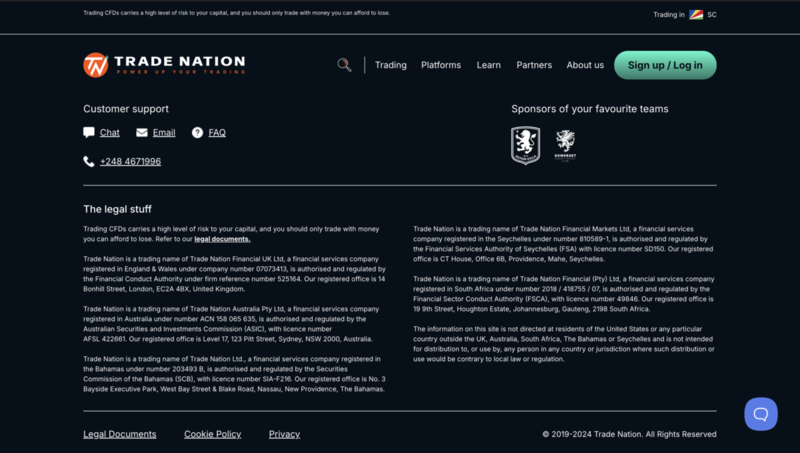

Trade Nation operates under the regulation of several reputable financial authorities, ensuring a high level of oversight and protection for its clients.

Regulatory Overview

Trade Nation is regulated by several prominent financial authorities, enhancing its credibility and ensuring robust oversight:

• Financial Conduct Authority (FCA): Regulated by the FCA in the UK, Trade Nation adheres to stringent regulatory standards. The FCA is known for its rigorous requirements aimed at protecting traders and ensuring fair market practices. This includes maintaining client funds in segregated accounts and adhering to transparency and conduct rules.

(View Here)

• Australian Securities and Investments Commission (ASIC): As regulated by ASIC in Australia, Trade Nation complies with ASIC’s stringent guidelines. ASIC is recognized for its high standards in broker regulation, including ensuring the financial stability of brokers and protecting clients through comprehensive regulatory measures.

(Search Here)

See more Trade Nation’s Regulatory Compliance

Financial Services Authority (FSA): Trade Nation is also regulated by the FSA in the Seychelles. The FSA oversees financial services and ensures that brokers adhere to appropriate standards for the protection of investors and market integrity.

(View Here)

Financial Sector Conduct Authority (FSCA): In South Africa, Trade Nation is regulated by the FSCA. The FSCA ensures that brokers operate with transparency and fairness, providing an additional layer of protection for traders.

(View Here)

Securities Commission of The Bahamas (SCB): Trade Nation’s regulation by the SCB reinforces its commitment to regulatory compliance. The SCB oversees brokers to ensure they operate within legal and ethical standards, contributing to a secure trading environment.

Compensation Fund

Trade Nation is covered by the Financial Services Compensation Scheme (FSCS) in the UK, offering protection up to £85,000 per client. This fund compensates traders if Trade Nation fails to meet its financial obligations, further enhancing the safety net for clients.

Safety Measures

Trade Nation implements robust safety measures to protect client funds and personal information. Client funds are kept in segregated accounts, separate from the broker’s operational funds, reducing the risk of misuse. Additionally, Trade Nation employs advanced encryption technologies to safeguard personal and financial data against cyber threats.

Trade Nation Account Types: Which is Right for You?

Trade Nation offers a range of account types to cater to different trading styles and requirements:

- Standard Account: The Standard Account is ideal for beginners and those seeking a simple trading experience. It features competitive spreads starting from 1.5 pips and no commission fees. This account type is designed to provide a straightforward fee structure, making it accessible for new traders.

- ECN Account: The ECN Account is suited for experienced traders who require direct market access and low spreads. It offers spreads starting from 0.2 pips and includes a commission of $10 per million traded. This account type is ideal for high-frequency traders and those using scalping strategies.

- VIP Account: The VIP Account is tailored for professional traders who demand premium trading conditions. It provides ultra-tight spreads and lower commission rates compared to the ECN Account. VIP Account holders also benefit from priority support and access to advanced trading tools.

- Multi-Asset Account: The Multi-Asset Account allows traders to diversify their portfolios across a broad range of asset classes, including forex, stocks, commodities, and indices. This account type is designed for those looking to trade a variety of financial instruments from a single platform.

See more Trade Nation’s Account Type details

Available Soon

Available Soon

Available Soon

Available Soon

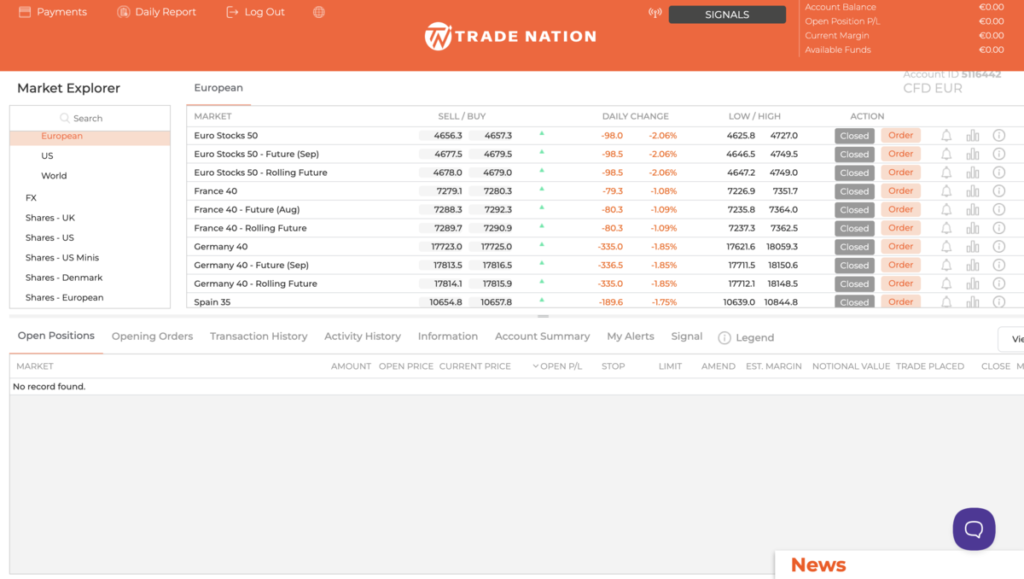

Explore Trade Nation Trading Platforms: MT4, MT5, Proprietary Solutions and Trading View Integration

Trade Nation offers an extensive selection of trading platforms tailored to fit a variety of trading styles and needs:

- MetaTrader 4 (MT4): MT4 is a widely used platform known for its reliability and comprehensive trading tools. It supports automated trading through Expert Advisors (EAs) and offers advanced charting capabilities. MT4 is favored by traders for its user-friendly interface and extensive functionality.

- MetaTrader 5 (MT5): MT5 is the successor to MT4 and includes additional features such as more timeframes, an integrated economic calendar, and enhanced charting tools. It supports a wider range of financial instruments, making it suitable for traders who need a more robust platform for diverse trading strategies.

- Trade Nation WebTrader: A browser-based platform that provides easy access to trading features without requiring any downloads. It offers a user-friendly interface and essential trading tools for effective trading.

- Trade Nation MobileTrader: Available on iOS and Android, this mobile platform allows traders to manage their accounts and execute trades from their smartphones. It ensures that traders can stay connected to the markets and make decisions on the go.

- TradingView Integration: Trade Nation integrates with TradingView, a leading charting and social trading platform. TradingView offers advanced charting tools, a wide range of technical indicators, and real-time data, allowing traders to analyze markets more effectively. The platform also features a social component, where traders can share ideas, strategies, and insights with the TradingView community. This integration provides Trade Nation users with enhanced charting capabilities and access to a vibrant trading community.

Trade Nation Trading Instruments: How many Markets You can Trade?

Trade Nation offers a diverse range of trading instruments, catering to various trading preferences and strategies. Here’s an overview of the markets and instruments available:

- Forex: Trade Nation provides access to a wide array of forex pairs, including major, minor, and exotic currency pairs. This allows traders to engage in currency trading with extensive options and liquidity.

- Stocks and ETFs: Traders can access global stock markets and a range of Exchange-Traded Funds (ETFs) through Trade Nation. This includes prominent stock exchanges from around the world and various ETFs that track different sectors and indices.

- Indices and Futures: Trade Nation offers trading on major world indices such as the S&P 500, NASDAQ, and FTSE 100. Futures contracts are also available, allowing traders to speculate on the future price movements of various commodities and financial instruments.

- Commodities: The broker provides options to trade in precious metals like gold and silver, as well as energy commodities such as oil and natural gas. This range of commodities allows traders to diversify their portfolios and hedge against market volatility.

- Bonds: Trade Nation includes bonds as part of its trading instruments. Traders can access various government and corporate bonds, providing an additional avenue for portfolio diversification and income generation. Bonds are often used for their lower risk and steady returns compared to more volatile instruments.

Diversified Market Access

Trade Nation’s comprehensive range of instruments ensures that traders can diversify their trading strategies and manage risk effectively across different asset classes. Whether you’re trading forex, stocks, commodities, or bonds, Trade Nation provides a robust platform to execute your trading strategies and achieve your investment goals.

Trade Nation Spreads, Fees, and Commissions: Transparent and Competitive

Trade Nation is transparent about its pricing structure, with fees varying by account type and trading platform (View Here):

Standard Account:

• Spreads: Starting from 1.5 pips

• Commissions: None

• Fees: Simple fee structure ideal for beginners

ECN Account:

• Spreads: Starting from 0.2 pips

• Commissions: $10 per million traded

• Fees: Designed for high-frequency traders with low spreads and direct market access

VIP Account:

• Spreads: Ultra-tight

• Commissions: Lower than ECN Account

• Fees: Premium trading conditions with additional benefits

Promotions and Bonuses

Trade Nation occasionally offers promotions, including deposit bonuses and trading contests. These promotions are designed to enhance trading conditions and provide additional value to traders.

Trade Nation Customer Service and Support: 24/7 Availability

Trade Nation excels in providing exceptional customer support, available around the clock through various channels:

• Live Chat: For immediate assistance on the broker’s website.

• Email: For detailed inquiries and support.

• Phone: Direct access to support representatives for urgent issues.

• Multilingual Support: Assistance in multiple languages ensures that traders from different regions can receive help in their preferred language.

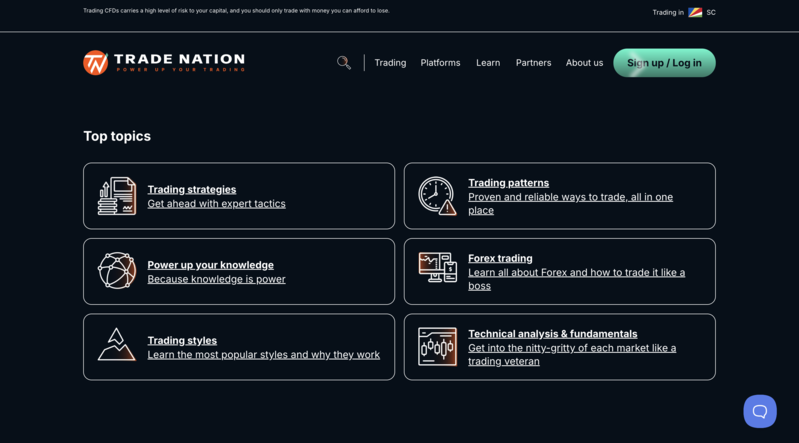

Educational Resources and Tools: Learning with Trade Nation

Trade Nation offers a comprehensive suite of educational resources and tools to support traders at all levels:

• Training Videos and Webinars: Covering fundamental and advanced trading strategies, market analysis, and platform usage.

• Articles and E-books: Detailed guides on trading concepts, risk management, and trading psychology.

• Demo Accounts: Allowing traders to practice strategies and test ideas without financial risk.

• Analytical Tools: Advanced charting tools, economic calendars, and real-time market news to aid in informed decision-making.

Our Conclusion: How Trade Nation Measures Up in the Forex Brokerage Industry

"Trade Nation distinguishes itself as a reliable and feature-rich broker with a strong emphasis on transparency, competitive pricing, and comprehensive support. Its regulation by top-tier authorities such as the FCA and ASIC ensures a secure trading environment. With a range of account types, diverse trading platforms, and robust educational resources, Trade Nation caters to traders of all experience levels. While it may have some limitations in terms of cryptocurrency offerings, its overall strengths make it a solid choice for those seeking a dependable and cost-effective trading experience."

whatsthebestbroker.com