FBS is a versatile Forex broker offering diverse account types, competitive pricing, and strong support. Ideal for traders of all levels seeking growth.

Quick Overview:

| Website: | fbs.com | |

| License: | 🇲🇺 FSC | |

| Established: | 2009 | |

| Broker Type: | ECN, MM | |

| Instruments: | 550+ | |

| Max Leverage: | 1:3000 | |

| Min Deposit: | 5$ | |

| Fees: | Low | |

| Support: | 24/7 |

| Segregated accounts | ||

| Compensation Fund | ||

| Algo Trading | ||

| Copy Trading | ||

| PAMM Accounts | ||

| Signals | ||

| Demo Account | ||

| Cent Account | ||

| Bonuses & Contests |

- More then 550+ Instruments

- Leverage up to 1:3000

- Comprehensive platform selection, including MT4, MT5, and cTrader

- Competitive pricing with transparent fee structures

- 24/7 multilingual customer support

- Doesn’t offer Cryptocurrencies

- Some withdrawal methods incur fees

FBS Review 2024: Is It the Best Forex Broker for You?

Introduction

Established in 2009, FBS has positioned itself as a leading Forex broker, providing an extensive range of trading instruments and innovative solutions tailored to meet the diverse needs of traders around the globe. With a focus on offering competitive spreads, multiple trading platforms, and excellent customer service, FBS caters to both novice and experienced traders. This in-depth review will explore the key aspects of FBS, including its regulatory standing, account types, trading platforms, fees, and educational resources, helping you determine if FBS is the right broker for your trading journey.

Regulation and Safety: Is RoboForex a Safe Broker?

When choosing a Forex broker, regulation and safety are paramount. FBS operates under the regulation of the International Financial Services Commission (IFSC) of Belize, under license number IFSC/60/230/TS/19. This regulatory oversight provides a level of security for clients, ensuring that the broker adheres to certain operational standards.

Civil Liability Insurance:

FBS has implemented a Civil Liability insurance program that covers up to €5,000,000, protecting clients from potential financial losses arising from errors, omissions, or fraudulent activities. This insurance helps build confidence among traders, allowing them to focus on their trading strategies without undue concern about the safety of their capital.

See more FBS Regulatory Compliance

Compensation Fund:

As a member of the Financial Commission, FBS is part of a compensation fund that offers financial protection of up to €20,000 per case. This fund is designed to safeguard traders in situations where FBS fails to comply with a ruling from the Financial Commission, providing an additional layer of security for traders’ funds.

Trade Execution Quality:

FBS is committed to maintaining high standards of service, regularly undergoing evaluations of its trade execution quality in partnership with the Financial Commission. This ensures that traders receive a fair and transparent trading experience, further enhancing the broker’s reputation for reliability.

FBS Account Types: Which is Right for You?

FBS offers a diverse selection of account types designed to meet the needs of different trading strategies and experience levels. Here’s a breakdown of the main account types available:

- Standard Accounts: These accounts are tailored for beginners, offering low spreads and no commission fees. They are ideal for those just starting in Forex trading who want to keep their costs minimal while learning the ropes.

- Cent Accounts: Aimed at novice traders and those looking to minimize risk, Cent Accounts allow trading with small amounts, making it easier for beginners to gain experience without significant financial exposure.

- ECN Accounts: For more experienced traders, ECN Accounts provide direct market access, tight spreads, and a commission-based structure. These accounts are perfect for those who require fast execution and transparency in their trading operations.

- Crypto Accounts: As the popularity of cryptocurrencies continues to rise, FBS offers dedicated accounts for trading various digital assets, including Bitcoin and Ethereum. These accounts allow traders to capitalize on the volatility and potential profitability of the cryptocurrency market.

- Islamic Accounts: FBS caters to Muslim traders by offering Islamic Accounts that comply with Sharia law. These accounts feature swap-free trading conditions, ensuring that traders can participate without violating their religious principles.

See more FBS Account Type details

Available Soon

Available Soon

Available Soon

Explore FBS Trading Platforms: MetaTrader 4, MetaTrader 5, and More

FBS provides a variety of trading platforms to accommodate different trading preferences and styles:

- MetaTrader 4 (MT4): A globally recognized platform, MT4 is favored for its comprehensive features, including advanced charting tools, a wide range of technical indicators, and the ability to automate trading strategies through Expert Advisors (EAs). The platform’s user-friendly interface makes it suitable for both beginners and seasoned traders.

- MetaTrader 5 (MT5): The successor to MT4, MT5 offers additional features such as more timeframes, advanced order types, and an integrated economic calendar. This platform is ideal for traders who want a more sophisticated trading environment with enhanced analytical capabilities.

- FBS Trader App: This mobile application allows traders to manage their accounts and execute trades on the go. With a user-friendly interface and real-time market access, the FBS Trader App ensures that traders can stay connected to the markets, no matter where they are.

- WebTrader: FBS also offers a browser-based platform known as WebTrader, which requires no downloads. This platform provides easy access to trading accounts and features essential tools for executing trades efficiently from any internet-enabled device.

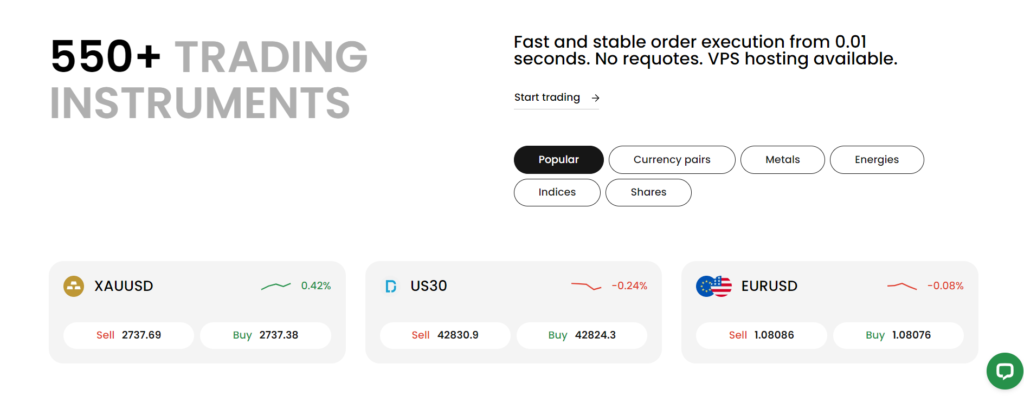

FBS Trading Instruments: How many Markets You can Trade?

FBS offers a vast selection of trading instruments, allowing traders to explore multiple markets:

- Forex: The primary focus of FBS is Forex trading, providing access to a comprehensive range of major, minor, and exotic currency pairs. Traders can benefit from competitive spreads and leverage options, making it suitable for a variety of trading strategies.

- Stocks and Indices: FBS enables traders to invest in global stock markets and major indices, including the S&P 500 and NASDAQ. This allows for portfolio diversification and the opportunity to profit from market movements beyond the Forex space.

- Commodities: FBS provides trading options in commodities such as precious metals like gold and silver, as well as energy products like oil and natural gas. These commodities can serve as effective hedges against market volatility.

- Cryptocurrencies: FBS supports trading in a growing list of cryptocurrencies, including Bitcoin, Ethereum, and Litecoin. This allows traders to capitalize on the volatility and potential profits offered by the digital currency market.

FBS Spreads, Fees, and Commissions: Transparent and Competitive

FBS is known for its competitive and transparent fee structure, which varies depending on the account type and trading platform used:

- Standard Accounts: Generally offer tight spreads without additional commission fees, making them appealing for beginners who want to keep trading costs low.

- ECN Accounts: These accounts incur commission fees based on trade volume. The spreads are tight, making them suitable for high-frequency traders looking to maximize profitability.

- Cent Accounts: Designed for low-volume trading, Cent Accounts feature minimal fees, allowing novice traders to practice without significant financial risk.

- Promotions and Bonuses: FBS frequently runs promotional campaigns, including bonuses on deposits and trading rebates. These offers can enhance trading conditions and provide additional incentives for new clients to engage with the platform.

FBS Customer Service and Support: 24/7 Availability

FBS places great emphasis on customer service, providing exceptional support to its clients 24/7. Traders can reach the support team through various channels, including live chat, email, and phone, ensuring that assistance is readily available. The multilingual support staff can handle inquiries in multiple languages, which is particularly beneficial for a global client base.

Many traders commend FBS for its prompt and knowledgeable responses, contributing to an overall positive trading experience. This high level of customer service enhances traders’ confidence in their decisions and helps them navigate any challenges they may encounter.

Educational Resources and Tools: Learning with FBS

FBS understands the importance of education in trading, and as such, it offers a comprehensive range of resources to support traders of all experience levels:

- Webinars and Tutorials: FBS hosts regular webinars and provides video tutorials covering fundamental and advanced trading strategies, platform usage, and market analysis. These resources are designed to equip traders with the knowledge they need to succeed.

- E-books and Articles: The broker offers extensive educational materials, including e-books and articles, that cover essential trading concepts, risk management strategies, and insights into market trends.

- Demo Accounts: FBS provides demo accounts that allow traders to practice their strategies without risking real money. This is a crucial tool for beginners to build their skills and for experienced traders to test new strategies in a risk-free environment.

- Market Analysis Tools: FBS provides traders with access to analytical resources, including economic calendars, technical analysis tools, and real-time market news updates. These resources empower traders to make informed decisions and stay updated on market developments.

Our Conclusion: How FBS Measures Up in the Forex Brokerage Industry

"FBS is a versatile Forex broker known for its advanced technology and diverse trading instruments. It emphasizes education, competitive pricing, and excellent customer support, fostering a positive trading environment. With solid regulatory backing and various account options for different trading styles, FBS appeals to both novice and experienced traders. Overall, its focus on client safety, competitive fees, and comprehensive educational resources makes FBS a reliable partner for success in the Forex and CFD markets."

whatsthebestbroker.com