Doto is a multi-asset trading platform offering forex, stocks, crypto, and commodities with a user-friendly interface, advanced tools, and competitive pricing.

Quick Overview:

| Website: | doto.com | |

| License: | 🇨🇾 CySec 🇲🇺 FSC 🇿🇦 FSCA | |

| Established: | 2019 | |

| Broker Type: | STP | |

| Instruments: | 130+ | |

| Max Leverage: | 1:500 | |

| Min Deposit: | 15$ | |

| Fees: | Low | |

| Support: | 24/7 |

| Segregated accounts | ||

| Compensation Fund | ||

| Algo Trading | ||

| Copy Trading | ||

| PAMM Accounts | ||

| Signals | ||

| Demo Account | ||

| Cent Account | ||

| Bonuses & Contests |

- More then 130 Instruments

- Leverage up to 1:500

- Comprehensive platform selection, including MT4, MT5

- Competitive pricing with transparent fee structures

- 24/7 multilingual customer support

- Doesn’t offer Cryptocurrencies

- Some withdrawal methods incur fees

Doto Review 2024: Is It the Best Forex Broker for You?

Introduction

Doto is an emerging online broker that provides a range of trading opportunities, allowing users to trade in various financial markets, including forex, stocks, indices, and commodities. The broker aims to offer a streamlined trading experience with competitive spreads, multiple account types, and the popular MetaTrader platforms. However, given the variety of options available in the brokerage industry, it’s essential to evaluate whether Doto meets your specific trading needs. In this detailed Doto review, we will assess the broker’s regulation, trading conditions, platforms, and customer support to help you determine if Doto is the right fit for you.

Regulation and Safety: Is RoboForex a Safe Broker?

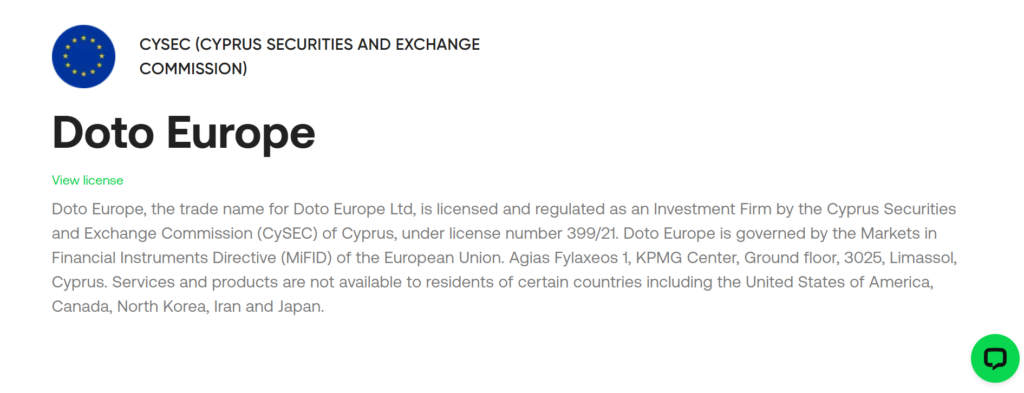

When choosing a broker, one of the most important factors to consider is its regulatory status and the measures it takes to protect client funds. Doto is regulated by the Cyprus Securities and Exchange Commission (CySEC), under license number 299/16. As part of the European Union, Cyprus follows the MiFID II (Markets in Financial Instruments Directive), which imposes strict regulatory guidelines to ensure transparency and client protection in financial markets.

CySEC regulation provides traders with a sense of security, knowing that the broker adheres to rigorous financial standards. Additionally, Doto segregates client funds from its operating capital, ensuring that trader deposits are protected even if the broker encounters financial difficulties.

Civil Liability Insurance:

Though Doto does not offer a Civil Liability Insurance plan like some other brokers, its regulation under CySEC provides robust protection through strict capital requirements and oversight, which are designed to safeguard traders’ funds.

See more Doto’s Regulatory Compliance

Compensation Fund:

Doto is a participant in the Investor Compensation Fund (ICF), which offers an extra layer of protection. If the broker were to become insolvent, eligible clients could be compensated up to €20,000. This is a standard protection measure for CySEC-regulated brokers, ensuring that traders can recover part of their investment in case of unexpected financial issues.

Verify My Trade Certification:

Doto ensures transparency in its trade execution by partnering with Verify My Trade (VMT), which provides a certification based on the quality of trade execution. By submitting trade data for regular audits, Doto demonstrates its commitment to ensuring that traders receive fair and competitive execution prices.

RoboForex Account Types: Which is Right for You?

Doto offers a selection of account types that cater to various levels of traders, from beginners to professionals. Here’s a breakdown of the account options:

Standard Account

The Standard Account is ideal for those who are new to trading or prefer a straightforward, commission-free structure. It has a minimum deposit requirement of just $100, making it accessible to a wide range of traders. Spreads start from 1.5 pips, and leverage is capped at 1:30 for retail clients, in line with EU regulations. This account type is a great choice for traders looking to start with a modest investment and avoid commission fees.

Pro Account

Designed for more experienced traders, the Pro Account offers tighter spreads starting from 0.1 pips. The minimum deposit is $500, and a small commission is charged per trade. This account provides more professional-level trading conditions and is ideal for traders who prioritize tighter spreads and are comfortable with a commission-based fee structure.

Islamic Account

For traders following Islamic finance principles, Doto offers a swap-free Islamic Account. This account removes any interest on overnight positions, allowing traders to comply with Sharia law while maintaining the same trading conditions as the Standard and Pro accounts.

Demo Account

Traders who want to explore Doto’s offerings without financial risk can open a demo account. This account provides access to real-time market conditions and virtual funds, making it an excellent tool for both beginners and experienced traders to test strategies and get familiar with the platforms.

See more Doto’s Account Type details

Available Soon

Available Soon

Available Soon

Explore Doto Trading Platforms: MT4, MT5, R StockTrader, and More

Doto provides access to two of the most popular and powerful trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are highly regarded for their robust features, ease of use, and support for automated trading strategies through Expert Advisors (EAs).

MetaTrader 4 (MT4): This platform is widely favored by forex traders for its simplicity and powerful charting tools. MT4 supports numerous technical indicators, advanced charting capabilities, and the ability to automate trading strategies using EAs. It is available on desktop, web, and mobile, allowing traders to stay connected to the markets from anywhere.

MetaTrader 5 (MT5): The MT5 platform offers all the features of MT4 but with added capabilities, such as more order types, additional timeframes, and access to a broader range of markets, including stocks and commodities. It’s a better choice for traders looking to diversify beyond forex and benefit from advanced tools like the integrated economic calendar.

Both platforms allow for seamless access across devices, whether you are trading from a desktop computer, tablet, or smartphone, making it convenient for traders on the move.

Doto’s Trading Instruments: A Diverse Range of Markets?

Doto provides access to a wide range of trading instruments across various asset classes, enabling traders to diversify their portfolios and find opportunities in different markets.

Forex: Doto offers over 60 currency pairs, including major, minor, and exotic pairs. With competitive spreads and fast execution speeds, forex trading remains one of the broker’s core offerings.

Stocks: Traders can speculate on a wide range of global stocks via CFDs, allowing them to take advantage of price movements without owning the underlying asset. Doto offers shares from leading companies listed on major stock exchanges such as the NYSE, NASDAQ, and LSE.

Indices: Doto allows traders to access major global indices, including the S&P 500, NASDAQ, FTSE 100, and DAX. These instruments offer high liquidity and can be a good way to trade on the overall performance of a stock market.

Commodities: Commodities such as gold, silver, oil, and natural gas are available for trading, providing opportunities for traders looking to hedge or diversify into physical assets.

ETFs: Exchange-traded funds (ETFs) are also available, enabling traders to gain exposure to a diversified portfolio of assets in a single trade.

Doto Spreads, Fees, and Commissions: Transparent and Competitive

Doto offers competitive trading conditions, with spreads and fees varying depending on the account type:

Standard Account: With spreads starting from 1.5 pips and no commissions, the Standard Account is ideal for traders who prefer a commission-free structure.

Pro Account: This account features spreads starting from 0.1 pips, but traders are charged a small commission per trade. The tighter spreads are designed to cater to high-volume and professional traders who prioritize better pricing accuracy.

While Doto does not charge deposit fees, some withdrawal methods may incur fees. It’s recommended to review the broker’s withdrawal options carefully to choose the most cost-effective method.

Doto Customer Support: Reliable and Accessible

Customer support is a crucial aspect of a trader’s experience, and Doto offers reliable assistance to its users. Support is available 24/7 via live chat, email, and phone, covering all business days. The support team is multilingual, ensuring that traders from different regions can receive help in their native language. The broker also provides an extensive FAQ section on its website, answering many common questions related to trading accounts, platforms, and fees.

Educational Resources: Learn and Grow with Doto

Doto places a strong emphasis on trader education, offering various resources to help users improve their trading knowledge and skills:

Webinars and Tutorials: The broker offers webinars on topics such as market analysis, technical strategies, and trading psychology. Video tutorials are also available for users who prefer a self-paced learning environment.

Market Analysis and News: Doto’s website features a dedicated market news and analysis section that keeps traders informed of the latest market developments and economic events. This resource is valuable for those looking to incorporate fundamental analysis into their trading strategies.

Trading Tools: Doto provides a range of tools such as an economic calendar, real-time news feeds, and advanced charting capabilities, ensuring traders have access to the information they need to make informed decisions.

Our Conclusion: How RoboForex Measures Up in the Forex Brokerage Industry

"Doto is a reliable and versatile broker, offering competitive pricing, user-friendly platforms, and strong regulation. With a wide range of trading instruments, educational resources, and responsive customer support, it caters to both beginners and experienced traders. Whether you want to start with a demo account or seek advanced tools for tight spreads, Doto is a strong option for many types of traders."

whatsthebestbroker.com