FirewoodFX offers competitive spreads, high leverage, MT4 platform, and cent accounts, making it suitable for both beginner and experienced traders.

Quick Overview:

| Website: | fxwoodfx.com | |

| License: | 🇸🇨 FSA | |

| Established: | 2014 | |

| Broker Type: | STP | |

| Instruments: | 50+ | |

| Max Leverage: | 1:3000 | |

| Min Deposit: | 10$ | |

| Fees: | Low | |

| Support: | 24/5 |

| Segregated accounts | ||

| Compensation Fund | ||

| Algo Trading | ||

| Copy Trading | ||

| PAMM Accounts | ||

| Signals | ||

| Demo Account | ||

| Cent Account | ||

| Bonuses & Contests |

- Leverage up to 1:3000

- Comprehensive platform selection, including MT4

- Competitive pricing with transparent fee structures

- Swap-free Islamic Accounts Available

- 24/5 multilingual customer support

- No Compensation Fund or Civil Liability Insurance

- Does not offer access to cryptocurrencies, individual stocks, or ETFs

- Some withdrawal methods incur fees

FirewoodFX Review 2024: Is It the Best Forex Broker for You?

Introduction

FirewoodFX, established in 2014, is a relatively new player in the Forex brokerage industry but has managed to carve a niche for itself by offering a simplified approach to trading. The broker has attracted global clients with its competitive spreads, multiple account types, and access to the popular MetaTrader 4 (MT4) trading platform. While FirewoodFX may not have the same level of recognition as some larger brokers, its streamlined services and focus on essential features make it a viable option for traders looking for a no-frills trading experience. This detailed review will take you through every aspect of FirewoodFX, including its regulation, account types, trading platforms, fees, customer support, and more, helping you decide if it is the right broker for you.

Regulation and Safety: Is FirewoodFX a Safe Broker?

One of the first concerns any trader has when selecting a broker is the level of safety and regulation. FirewoodFX is registered in Saint Vincent and the Grenadines, a jurisdiction that has become popular among Forex brokers due to its more relaxed regulatory environment. While this allows the broker to offer higher leverage and more flexible terms, it also means that FirewoodFX is not regulated by top-tier authorities like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC).

This lack of stringent regulatory oversight may raise concerns for traders who prioritize security. However, FirewoodFX does take measures to ensure the safety of its clients’ funds. The broker maintains segregated accounts, meaning that client funds are kept separate from the company’s operational funds. This ensures that even in the unlikely event of the broker facing financial difficulties, client funds remain protected. FirewoodFX also employs advanced encryption technologies to safeguard traders’ personal data and transactions, adding an extra layer of security.

Unlike some brokers that offer civil liability insurance or compensation schemes, FirewoodFX does not have these additional protections in place. While the broker provides basic security measures, traders seeking the highest level of regulatory assurance may find FirewoodFX lacking in this area

Civil Liability Insurance:

FirewoodFX is not a member of any compensation fund, which is another common feature offered by brokers regulated in more stringent jurisdictions. Compensation funds are designed to protect traders in case the broker becomes insolvent or fails to comply with a legal ruling. Many top-tier brokers provide compensation up to a certain limit per client. Without this, FirewoodFX traders may face greater risks if the broker encounters financial issues.

See more FirewoodFX’s Regulatory Compliance

Compensation Fund:

FirewoodFX is not a member of any compensation fund, which is another common feature offered by brokers regulated in more stringent jurisdictions. Compensation funds are designed to protect traders in case the broker becomes insolvent or fails to comply with a legal ruling. Many top-tier brokers provide compensation up to a certain limit per client. Without this, FirewoodFX traders may face greater risks if the broker encounters financial issues.

Verify My Trade Certification:

FirewoodFX does not have a Verify My Trade (VMT) certification, a quality mark that some brokers use to validate their execution quality through an independent service. VMT certification assures traders that their broker’s trade execution is regularly audited and meets industry standards for transparency and accuracy. Although FirewoodFX employs standard security measures such as segregated accounts and encryption, the absence of third-party verification like VMT certification means that traders will have to rely on the broker’s internal processes for ensuring trade fairness and accuracy.

FirewoodFX Account Types: Which is Right for You?

FirewoodFX offers three primary account types designed to suit a range of trading styles and experience levels:

Micro Account: This account is geared toward beginner traders or those who want to trade with minimal risk. It features a minimum deposit requirement of just $10, making it highly accessible for new traders. The Micro account offers fixed spreads starting from 2 pips, which can be helpful for those who prefer predictability in their trading costs.

Standard Account: The Standard account is aimed at more experienced traders who require access to a broader range of instruments and more flexible trading conditions. It comes with a minimum deposit of $100 and offers floating spreads starting from 1 pip. With leverage up to 1:1000, this account is suited for traders who prefer to use higher leverage to maximize their trading potential.

Premium Account: The Premium account is designed for professional traders who demand the best trading conditions. It offers even tighter spreads and faster execution speeds compared to the Standard and Micro accounts. However, the minimum deposit for this account is higher at $500. Traders who opt for the Premium account will benefit from more competitive spreads, starting from 0.8 pips, and access to better liquidity.

All account types come with the option of Islamic accounts, which are swap-free to comply with Sharia law. This makes FirewoodFX an inclusive broker that caters to traders from various cultural and religious backgrounds.

See more FirewoodFX’s Account Type details

Cent

Micro

Standard

Premium

ECN

| Minimum Deposit | 10 USD |

| Base Currency | USC (1 USD = 100 USC) |

| Contract Size per 1 lot | USC 100,000 |

| Value 1 lot per pip / per point* | USC 10 per pip / USC 1 per point |

| Minimum Trade Size | 0.01 cent lot (1,000) |

| Maximum Trade Size | 100 cent lot (100,000) |

| Maximum Open Position | 200 Positions |

| Leverage | Up to 1:3000 |

| Spreads | Floating from 1 Pip |

| Pricing Format | 5-digits (1.23456) (.c suffix) |

| Commission | None |

| Swap | Yes, Islamic Account Available |

| Stopout Level | 20% |

| Stop and Limit Level | 2 Pips |

| Minimum Deposit | 10 USD |

| Base Currency | USD |

| Contract Size per 1 lot | USC 10,000 |

| Value 1 lot per pip / per point* | USD 1 per pip / USD 0.1 per point |

| Minimum Trade Size | 0.01 micro lot (100) |

| Maximum Trade Size | 200 micro lot (200,000) |

| Maximum Open Position | 200 Positions |

| Leverage | Up to 1:1000 |

| Spreads | Fix from 3 Pip |

| Pricing Format | 5-digits (1.23456) (.m suffix) |

| Commission | None |

| Swap | Yes, Islamic Account Available |

| Stopout Level | 20% |

| Stop and Limit Level | 2 Pips |

| Minimum Deposit | 10 USD |

| Base Currency | USD |

| Contract Size per 1 lot | USC 100,000 |

| Value 1 lot per pip / per point* | USD 10 per pip / USD 1 per point |

| Minimum Trade Size | 0.01 lot (1,000) |

| Maximum Trade Size | 30 lot (3,000,000) |

| Maximum Open Position | 200 Positions |

| Leverage | Up to 1:1000 |

| Spreads | Fix from 2 Pip |

| Pricing Format | 4-digits (1.2345) (.fw suffix) 5-digits (1.23456) (.f suffix) |

| Commission | None |

| Swap | Yes, Islamic Account Available |

| Stopout Level | 20% |

| Stop and Limit Level | 2 Pips |

| Minimum Deposit | 10 USD |

| Base Currency | USD |

| Contract Size per 1 lot | USC 100,000 |

| Value 1 lot per pip / per point* | USD 10 per pip / USD 1 per point |

| Minimum Trade Size | 0.01 lot (1,000) |

| Maximum Trade Size | 50 lot (5,000,000) |

| Maximum Open Position | 200 Positions |

| Leverage | Up to 1:1000 |

| Spreads | Floating from 0.3 Pip |

| Pricing Format | 5-digits (1.23456) (.e suffix) |

| Commission | None |

| Swap | Yes, Islamic Account Available |

| Stopout Level | 20% |

| Stop and Limit Level | 2 Pips |

| Minimum Deposit | 200 USD |

| Base Currency | USD |

| Contract Size per 1 lot | USC 100,000 |

| Value 1 lot per pip / per point* | USD 10 per pip / USD 1 per point |

| Minimum Trade Size | 0.01 lot (1,000) |

| Maximum Trade Size | 50 micro lot (5,000,000) |

| Maximum Open Position | 200 Positions |

| Leverage | Up to 1:1000 |

| Spreads | Floating from 0 Pip |

| Pricing Format | 5-digits (1.23456) (no suffix) |

| Commission | 7 USD / lot |

| Swap | Yes, Islamic Account Available |

| Stopout Level | 20% |

| Stop and Limit Level | 2 Pips |

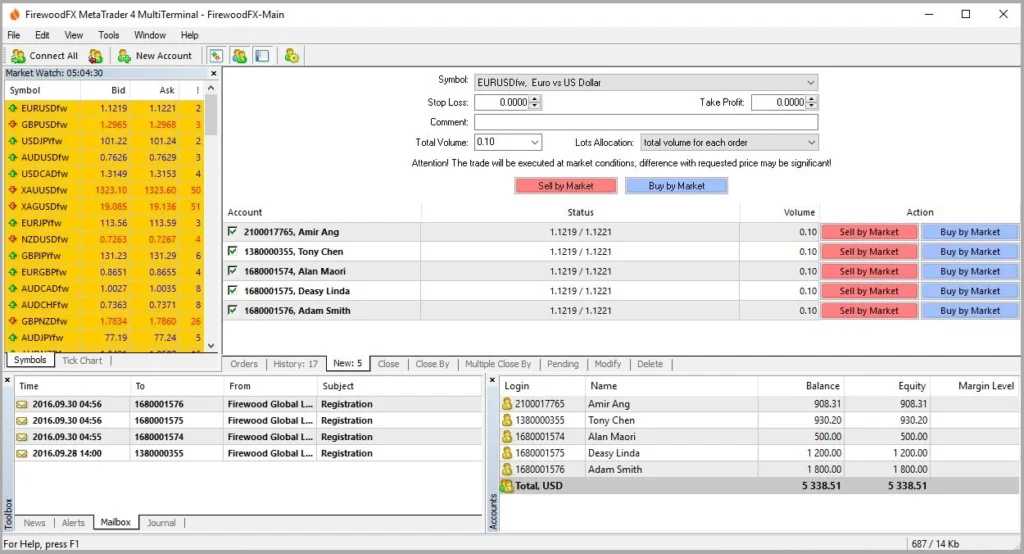

Explore FirewoodFX Trading Platforms: MT4 and Beyond

When it comes to trading platforms, FirewoodFX offers access to one of the most popular and reliable platforms in the industry: MetaTrader 4 (MT4). MT4 has earned its reputation as a robust, feature-rich platform that caters to traders of all experience levels. Whether you are a novice just starting with basic trades or an advanced trader using complex strategies, MT4 offers everything you need.

- MetaTrader 4 (MT4): MT4 is renowned for its advanced charting tools, customizable interface, and support for automated trading through Expert Advisors (EAs). FirewoodFX traders using MT4 can also take advantage of a wide range of technical indicators, multiple time frames, and the ability to create custom scripts for automated trading strategies. Moreover, MT4 is available for desktop, mobile, and web versions, ensuring that traders can access their accounts from anywhere and at any time.

- Mobile Trading: For traders who are always on the go, FirewoodFX supports mobile trading through the MT4 mobile app. Available for both Android and iOS devices, the mobile platform offers the same essential features as the desktop version, including charting tools, order management, and access to real-time market data.

While FirewoodFX does not offer MetaTrader 5 (MT5) or any proprietary trading platforms, the availability of MT4 ensures that traders have access to one of the most reliable and widely used platforms in the industry.

FirewoodFX Trading Instruments: What Markets Can You Trade?

FirewoodFX provides a decent range of trading instruments, although it is more limited compared to some larger brokers. Traders can choose from the following asset classes:

Forex: As a Forex-focused broker, FirewoodFX offers a wide variety of currency pairs, including major pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic pairs. This allows traders to diversify their currency trading strategies and explore different markets.

Commodities: In addition to Forex, traders can access commodity markets, including precious metals like gold and silver. These commodities are popular among traders looking to hedge against currency volatility or diversify their portfolios.

Indices: FirewoodFX offers a selection of major global indices, such as the S&P 500, NASDAQ, and FTSE 100, allowing traders to speculate on the performance of broader market segments.

While FirewoodFX offers the essential asset classes, it does not provide access to more exotic instruments like cryptocurrencies, individual stocks, or ETFs. This may be a limitation for traders looking for a more diverse range of markets.

FirewoodFX Spreads, Fees, and Commissions: Transparent and Competitive

FirewoodFX operates with a transparent fee structure, making it easy for traders to understand their trading costs upfront. The broker’s spreads and fees vary depending on the account type:

Micro Account: This account offers fixed spreads starting from 2 pips. While fixed spreads provide stability and predictability, they may not be as tight as floating spreads offered by some competitors. For new traders, however, fixed spreads can simplify the trading process.

Standard and Premium Accounts: These accounts feature floating spreads, starting from 1 pip for the Standard account and as low as 0.8 pips for the Premium account. FirewoodFX does not charge commissions on trades, making it an attractive option for traders who want to avoid additional fees.

Leverage: FirewoodFX offers highly competitive leverage, with rates up to 1:1000. While high leverage can increase potential profits, it also magnifies risk, so traders should use it cautiously.

FirewoodFX does not charge any deposit fees, but traders may incur withdrawal fees depending on the payment method they choose. It is worth noting that FirewoodFX does not offer rebates or significant promotional offers, which are sometimes available with other brokers.

FirewoodFX Customer Service and Support: 24/5 Availability

FirewoodFX offers customer support through multiple channels, including live chat, email, and phone. While the broker provides support 24/5, it does not offer 24/7 service, which could be a drawback for traders in different time zones who need assistance outside regular business hours. However, reviews of FirewoodFX’s support team are generally positive, with many traders praising the speed and professionalism of the customer service staff.

The broker also supports multiple languages, making it accessible to a global client base. However, FirewoodFX does not offer an extensive range of educational resources, such as webinars or training videos. Instead, it provides a basic FAQ section and some introductory articles on Forex trading. This could be a limitation for beginner traders who are looking for more comprehensive educational tools to improve their trading skills.

Educational Resources and Tools: What FirewoodFX Offers?

In terms of educational resources, FirewoodFX does not compete with larger brokers that offer in-depth trading courses, webinars, or video tutorials. While it provides some basic educational materials, such as articles on trading concepts and an FAQ section, these resources are quite limited compared to what other brokers offer.

However, the MT4 platform itself comes with a variety of analytical tools and real-time data that can help traders make informed decisions. Traders can also access an economic calendar and live market news feeds through the platform, which can be useful for fundamental analysis.

For more advanced traders who rely on technical analysis, FirewoodFX’s integration with MT4 provides access to a wide range of technical indicators, charting tools, and custom scripts for automated trading strategies. However, traders looking for in-depth educational materials or proprietary analysis tools may find FirewoodFX lacking in this area.

Our Conclusion: How FirewoodFX Measures Up in the Forex Brokerage Industry

"FirewoodFX distinguishes itself as a comprehensive broker equipped with advanced technological solutions and a wide range of trading instruments. Its commitment to providing robust educational resources and exceptional customer support reflects its dedication to supporting traders at all levels of experience. By maintaining a strong regulatory framework and offering a variety of platform choices, FirewoodFX ensures a reliable and efficient trading environment for those looking to engage with the Forex and CFD markets."

whatsthebestbroker.com